A nation must think before it acts.

Introduction

Russia and the West have found themselves enmeshed in an expansive economic war as a result of Russian President Vladimir Putin’s decision to launch the full-scale invasion of Ukraine on February 24, 2022. While the conflict on the ground in Ukraine is undoubtedly—and tragically—the primary front of Russia’s aggression, and where its aggression reaps its most dramatic horrors, Western powers have joined with a wide swathe of the international community to support Ukraine’s resistance and hold the Kremlin to account.

But as with the kinetic war in Ukraine, the conflict did not begin one evening last February. It was first launched by Russia in response to Ukraine’s pro-Western, anti-corruption Maidan Revolution that raged through the winter of 2013–2014, ultimately resulting in the ouster of Viktor Yanukovych after he sought to capitulate to the Kremlin and refuse protesters’ and the wider Ukrainian public’s demands for continuing the country’s pro-European and pro-Western agenda. Russia was the first power to use sanctions and trade restrictions in the conflict, namely against Ukraine in 2013.[1] Russia also first sought to use Ukraine’s future to bring the international economic order into the scope of its fight even before Yanukovych’s ouster.[2] However, economic and technology restrictions on Russia have been at the core of the wider West’s strategy of support for Ukraine throughout that period. The target of these tools has changed significantly, initially aimed at deterring Russia from further aggression after 2014 to seeking to restrict its state capacity and ability to wage the war since 2022. But their global impact and Putin’s attempts to undermine the international order through his own weaponization of Russia’s economy and its commodities base have left the world in a new era of international economic competition, and other powers, great and small, are being impacted in ways unforeseen. States are, in turn, also learning lessons from this new era of economic warfare for the future, and the risks they might face from such conflict.

This paper examines the impact on one often overlooked but deeply affected country, the Republic of Korea (or South Korea). Seoul has a unique position in the economic war in that it was arguably the largest Western ally that did not join the sanctions regime against Russia after Putin’s annexation of Crimea and fomenting conflict in eastern Ukraine in 2014. In fact, as we will see, a number of crucial economic ties between Russia and South Korea grew significantly thereafter; although this was also the case for a number of countries that induced sanctions—Germany’s gas linkages with Russia in the Nord Stream 2 pipeline are perhaps the best known example. This paper will examine Seoul’s strategic considerations in doing so, and the reasons that the West did not put substantial pressure on South Korea to join the sanctions regime at the time. Seoul did, however, join the sanctions regime fully in 2022. The domestic political considerations in South Korea played a key role in that shift and will also determine how the policy’s effectiveness is judged and, in turn, how South Korea may be positioned for future similar economic conflict between the West and China.

The Economic War with Russia

In order to frame the discussion of how Seoul fits into economic war, it is first important to define that conflict today and the influence of the conflict of the last decade. This understanding is important not only to discuss the scope of the conflict to date but also to differentiate it from other examples of interstate competition where economics and trade rules are often used by states to compete with one another. Great, regional, and even small powers engage in economic competition with each other all the time. Even allies engage in state-backed economic competition. The scale of the conflict between Russia and the wider West, however, is of a level far more significant than rival subsidies or desires to gain an advantage for any one industry.

Robert Blackwell and Jennifer Harris provided a framework for such interstate competition with the concept of geoeconomics in their 2016 book War by Other Means: Geoeconomics and Statecraft. They defined it as “the use of economic interests to promote and defend national interests, and to produce beneficial geopolitical results, and the effects of other nation’s economic actions on a country’s geopolitical goals.” Geoeconomics have been at the center of the global conflict between Russia and the West that emerged out of Putin’s 2014 invasion of Ukraine. The West aims to constrain Putin’s ability to wage offensive conflict. Putin aims to weaken, and arguably even destroy, the international economic order and replace it with an alternative that is more amenable to its interests.

This is the key difference between the economic war between Russia and the West and the economic competition and trade warfare between China and the West, at least since 2022, although the war in Ukraine set the groundwork for the escalation at its genesis in 2014. Economic competition between China and the West consists largely of a spat between the US and China over who will sit atop the international economic order. The position atop that order has been held by the US since the Second World War, and Washington also has an outsized role in setting the rules precisely because of the role that the US Dollar has in the global financial system, something that Beijing has increasingly chafed at. Russia has engaged in far more extensive efforts to actually undermine that order. For example, Russia tried to keep Ukraine indebted to Moscow without the ability to secure international support as seen in 2014. Additionally, in response to the wider West’s most significant sanctions against a great power since before the Second World War, Russia used gas supplies to Europe to precipitate a global economic crisis. Russia has also tried to undermine the US and its dollar’s paramount position, which enables Washington a sanctions power that no other country has, namely effective extra-territoriality. This means that US sanctions—whether financial restrictions targeting Russia’s banks or trade restrictions aimed at banning the use of technology, machinery, and intellectual property for the Kremlin’s war effort—can be enforced around the world. It is precisely that power that Russia seeks to erode, and ultimately eradicate.

Nevertheless, the fight is one that the US, even if it has led it, cannot fight alone. The US can enforce its sanctions by issuing fines or threatening restrictions against companies that violate them, and it is undoubtedly willing to do so even when it chafes relations with allies—whether in Russia’s case or others, for example in the 2018 unilateral withdrawal by the Trump Administration from the Joint Comprehensive Plan of Action (JCPOA). European countries and the wider West almost universally opposed that move, but they did not directly challenge the sanction, though there was ample discussion of payment systems aimed at mitigating the pain for European companies.[3] The more Washington attempts to ‘go it alone’ on sanctions in any one case, the more threat there is to its control of crucial chokepoints in the banking and financial system, which risks undermining the effectiveness of its ability to introduce sanctions in the long term. Additionally, the globalized nature of the economy means that many of the key technologies that the US seeks to deny to Russia, or any other future competitor, are largely not manufactured in the US, even when its companies own a large share of the underlying intellectual property. Additionally, there are many sectors of the global economy where the US plays only a small role or does not have significant influence.

Sanctions are the US and the wider West’s key tool in the economic war, but they have blowback costs for the countries imposing them. This can have substantial political ramifications, and the wider West is broadly more susceptible to these than Russia, or other sanctions-targeted countries such as the Democratic People’s Republic of Korea (North Korea) or Iran, because they have democratic accountability. The ability to wage economic war, and its effectiveness, therefore depends not only on the US but on how the wider West and international community supports, joins, and relates to them. With a crucial role in the global technology sector, a world-leading shipping industry, and a need to balance Euro-Atlantic security interests with its own security concerns in relation to North Korea, South Korea’s experience provides valuable lessons on how the wider West’s sanctions policy against Russia has developed and its implications for future major economic conflict.

The Development of Korea’s Sanctions Against Russia

Contrasting Responses: 2014 and 2022

While the American and European responses to Russia’s launch of the war in Ukraine in 2014 are, in retrospect, frequently criticized for being lackluster, South Korea’s reaction neared nonexistent. While Seoul joined in criticizing Russia’s actions, it did not impose any sanctions and continued with most ongoing joint economic projects. For the next few years, the South Korean foreign policy establishment pondered ideas to best circumvent Western sanctions on Russia. Confronting Russia for Crimea was never an option seriously considered by most foreign policy thinkers.

In 2022 however, South Korea much more proactively responded to Russia’s invasion of Ukraine. It imposed multiple financial and trade sanctions, condemned its actions, provided economic assistance to Ukraine, and is allegedly providing arms to countries that are sending weapons to Ukraine. South Korean officials, media, and the public overwhelmingly concur on the need to prevent Russia’s victory, albeit with significant divergences on the extent of effort they are willing to invest.

However, as will be explained in later sections, it is worth noting that the South Korean response has been gradual, nuanced, and often contradictory.

When Russian troops amassed near the Ukraine border in late 2021, South Korea did not join its Western partners in condemning Putin. When the invasion became imminent, with US intelligence suggesting the war could happen anytime soon, South Korean officials continued to stress the importance of Korea-Russia cooperation. When the war began, Seoul initially only expressed the intent to “join international sanctions.” It was only later that it decided to impose its own unilateral sanctions. While the change in government to the Yoon Suk Yeol administration in May 2022 led to a more pronounced alignment with the West, South Korea has been careful not to “completely burn the bridge with Russia.”

Despite continued assistance to Ukraine, even including indirect weapons sales, South Korea has been very careful to not antagonize Russia completely. While the US and its European allies officially designated Russia as a security threat, South Korean officials have insinuated that the Korea-Russia relations remain valuable. Unlike many European countries and Japan, Korea did not expel Russian diplomats. Russia has also measured its response to South Korea. Despite initial threats to help North Korea retaliate against South Korea’s assistance to Ukraine, there has been little evidence suggesting such actions. Furthermore, South Korean companies have maintained a limited but significant presence in the Russian market, often with the government’s help.

This report seeks to outline the following aspects of South Korea’s reactions and their implications.

The first section provides an overview of South Korea’s sanctions on Russia since February 2022, explores the types of sanctions the South Korean government imposed on Russia, and compares Korea-Russia trade since the war with previous records.

The second section reviews the status quo of South Korean companies operating in Russia and how they are managing the tricky market situation, sometimes with the help of the Korean government. This section further analyzes how South Korean companies are switching tactics to stay in the Russian market and if and where they are facing renewed competition from Chinese companies.

The third section considers the economic impact of sanctions and the Ukraine War on South Korea. It will include reports from major South Korean research institutes on their speculations of future scenarios.

The fourth section discusses current bilateral political relations and the deteriorating political tension between South Korea and Russia. Korea’s alignment with the West, particularly its indirect military support for Ukraine, rapidly cooled relations between South Korea and Russia.

The fifth section reflects the broader divergence in the conservatives’ and the progressives’ foreign policy outlook, specifically the partisan divide within South Korea on how to deal with Russia. While most Western powers are facing internal division over how to best respond to Russian aggression, South Korea is also undergoing intense domestic debate on the future of Korea-Russia relations.

The sixth section reviews existing literature on the implications of Russia sanctions for similar measures on China including export controls especially in case of a Taiwan contingency. Many draw a parallel between Ukraine and Taiwan, especially in terms of deterring a more powerful authoritarian aggressor.

March 2022: Korean Government joins Russia Financial Sanctions

In March 2022, the South Korean government joined the international community’s financial sanctions against Russia. Seoul announced that it will suspend financial transactions with major Russian banks, stop investing in government bonds, and exclude the country from the global financial communications network (SWIFT).[4]

The Ministry of Strategy and Finance issued a press release on March 1, saying it decided to take follow-up measures to join the sanctions against Russia, including SWIFT restrictions. The seven Russian banks and their subsidiaries that are subject to the sanctions are Sberbank, VEB, PSB, VTB, Otkritie, Sovcom, and Novikom. Domestic financial institutions, businesses, and individuals alike are suspended from conducting transactions with the affected banks.

However, South Korea maintained some exceptions, noting that “banks will be allowed to trade on the same basis as agricultural products, COVID-19 medical aid, energy-related transactions, and other sectors where the US has issued general permits and allowed transactions on an exceptional basis”.

The government also strongly advises domestic public institutions and financial institutions to suspend trading in all newly issued Russian government bonds past February 2.

“In particular, we will encourage public institutions to actively participate in the suspension of trading in Russian government bonds,” the ministry said. “Private financial institutions are also requested to take special care not to engage in related transactions so that the financial sanctions can be effectively implemented.”

“The South Korean government supports the exclusion of Russian banks from SWIFT and will implement future EU sanctions as soon as they are finalized.”

The SWIFT payment network is a global messaging system for financial transactions. It connects 11,000 banks in more than 200 countries to enable fast cross-border payments. Exclusion from SWIFT is one of the most powerful economic sanctions available. It restricts the ability to send and receive funds, such as import and export payments, to and from overseas financial institutions.

“We will continue to closely monitor the situation in Ukraine and the sanctions against Russia imposed by major countries such as the US and the EU, and promptly decide and implement additional sanctions in line with the international community’s needs,” said a government official.

March 2022: Korea Joins Financial Sanctions, Suspending Transactions with Central Banks and Sovereign Wealth Funds

The government has decided to suspend financial transactions with Russia’s central bank, sovereign wealth funds, and Bank Rossiya (Bank of Russia).

The government said in a press release on March 7 that it decided to further join the international community’s financial sanctions against Russia, taking into account the latest developments in Ukraine and the sanctions imposed on Russia by major powers such as the US and the EU. [5]

As a result, financial transactions with Russia’s central bank and sovereign wealth funds were suspended from April 8. However, banks will continue to be permitted to do business on the same basis as those sectors and entities for which the US has issued general licenses, including agricultural products, COVID-19 medical assistance, and energy-related transactions.

Previously, the US suspended transactions with Russia’s central bank and sovereign wealth funds on March 28. The EU also suspended transactions with the Russian central bank on March 28 and banned Russian sovereign wealth funds from participating in projects on March 2.

South Korea has also suspended transactions with Rossiya Bank, which was not among the seven SWIFT-excluded banks announced by the EU on February 2, though any such transactions would have already required US approval given that the bank was previously sanctioned by the US Treasury Department during the 2014 Crimea crisis.

With these additional sanctions, the government is suspending transactions with a total of 11 Russian institutions and subsidiaries. Investments in Russian sovereign debt were suspended as well in line with the sanctioning of the Central Bank of the Russian Federation.

“The financial authorities will provide detailed information on the grace period and types of transactions permitted under the US government’s general license to minimize inconvenience to financial institutions, citizens, and businesses during the implementation of the sanctions,” the government said.

February 2023: Unilateral Sanctions on Strategic Materials

In February 2023, the South Korean government banned the export of an additional 741 items to Russia, including machinery, automobiles, and chemicals that are likely to be diverted for military purposes, expanding its list of items requiring government permits to be exported to these countries from 57 to 798.[6]

On February 28, the Ministry of Trade, Industry and Energy (MOTIE) began enforcing the Amendment to the Notification of Import and Export of Strategic Goods to expand the number of Situationally Authorized Items for Export to Russia and Belarus from 57 to 798. Situationally Authorized Items are items that are not strategic goods but are prohibited from being exported in principle because they may be used for the development, production, transportation, or storage of weapons of mass destruction, missiles, and conventional weapons. The previous 57 items on the list were mostly electrical and electronic products, but the list has been greatly expanded to include general machinery, chemicals, and computers. The new export restrictions came into effect on April 24 203. [7]

The export ban includes quantum computers, which can be used for military encryption due to their superior performance compared to conventional computers; general mechanical parts such as bearings, which are widely used in the production of civilian transportation vehicles; and jewelry such as sapphires and rubies, which can be used in the production of optical products such as lasers, have also been included in the export ban.

Automobiles are also subject to export controls because they can be used to transport weapons and troops in case of emergency or for military purposes by removing major parts. However, in the case of automobiles, it is expected that there will be no major difficulties in exporting domestic used cars, most of which cost $50,000 or less.

“From now on, only exceptional cases, such as exporting existing contracts or exporting to a 100 percent subsidiary of a Korean corporation, can apply for a situation permit,” the MOTIE said. “We will also strengthen enforcement to prevent such items from entering Russia or Belarus bypassing third countries,” the ministry added.

South Korea-Russia Trade Since the Full-Scale Russian Invasion of Ukraine

According to the Korea International Trade Association, Russia fell to 15th place in terms of trade volume last year in the aftermath of the war in Ukraine, but it was the 10th largest trading partner before the war. South Korea imports petroleum products, crude oil, coal, and natural gas from Russia, and sells automobiles, auto parts, home appliances, and consumer goods.[8]

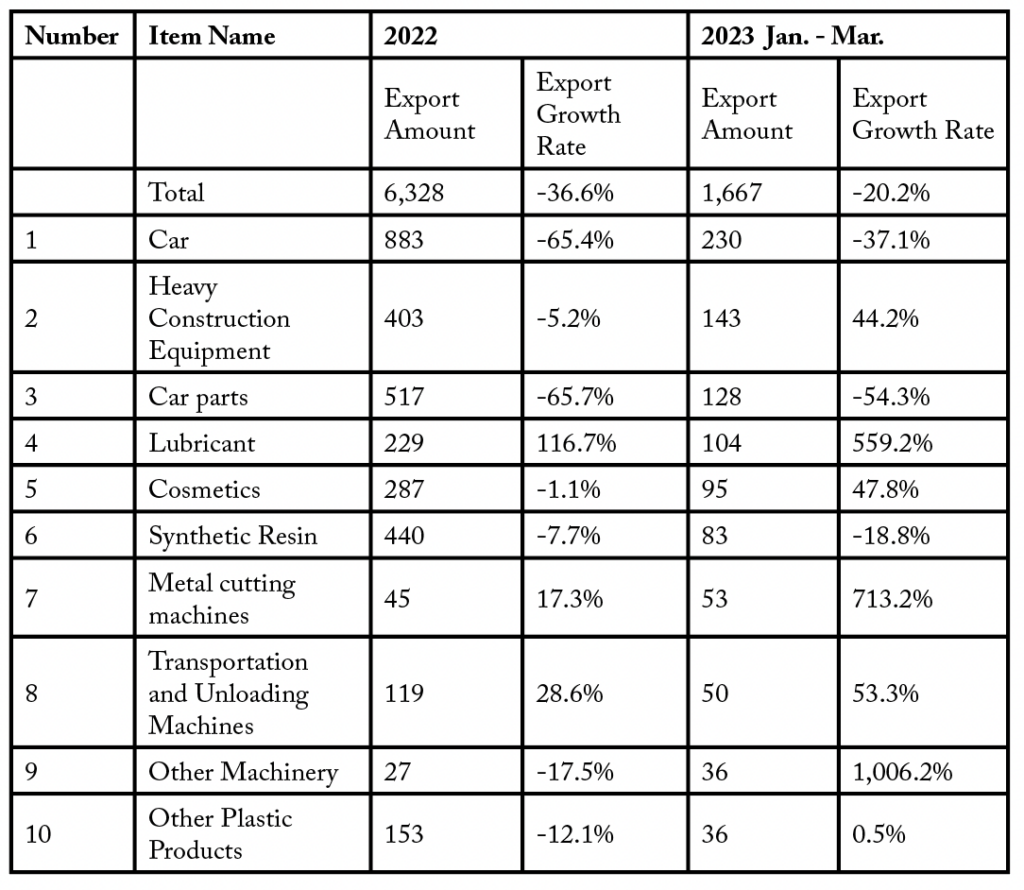

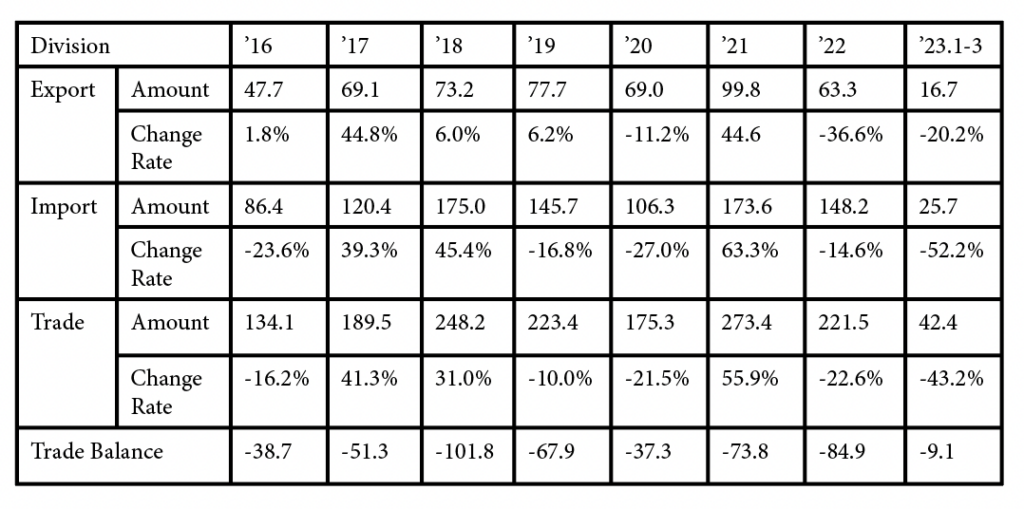

In 2022, South Korea’s trade (exports + imports) with Russia totaled $21.14 billion, down 22.6% from the previous year ($27.34 billion). In particular, exports plummeted 36.5% from $9.98 billion (KRW 12.93 trillion) to $6.33 billion (KRW 8.2036 trillion). This means that major conglomerates were unable to sell their products in the Russian market. So far this year, South Korea’s exports and imports to Russia have plummeted by 20.0% and 52.2%, respectively. Russia’s trade ranking for 2023 (January–March) dropped another two places to 17th.[9]

Top South Korean Exports to Russia

Source: The South Korean Embassy to Russia (April 2023)[10]

Top South Korean Imports from Russia

South Korea-Russia Trade Volume (Million dollar, %)[11]

Monthly Russian Import Trend (2022-2023) [12]

Overview of South Korean Companies Operating in Russia

As of early 2023, 160 Korean companies were operating in Russia.[13] Major conglomerates have both corporate and production bases in Russia. According to the Korea CXO Institute, 76 major Korean companies have subsidiaries in Russia, up from 63 in 2022.[14] Hyundai Motor Group has the most subsidiaries with 18, followed by Samsung and Lotte with nine each.[15] LG (eight subsidiaries), CJ (three), SK (two), Doosan (two), KT&G (two), and HMM (two) also have multiple entities in the country. Hyundai Motor, Samsung Electronics, LG Electronics, Lotte, Orion, and Faldo have established large-scale production plants in the region.

Since the outbreak of the war in Ukraine, major US and European companies have sold their plants in Russia or pulled out of the country. However, while many South Korean companies have shut down or restructured their Russian factories, most of them have not pulled out entirely yet. They are “trying to stay afloat locally by paying for labor, management, and maintenance costs.”[16] Many Korean companies are trying to hide their presence in Russia as much as possible to avoid being labeled “Russian enablers.”[17]

The presence of such companies does not necessarily undermine South Korea’s own sanctions or wider sanctions, but it raises the potential incentives for not complying with sanctions.

According to the MOTIE, Russia is currently home to more than 40 companies, including large conglomerates such as Samsung Electronics, LG Electronics, and Hyundai Motor.[18]

Samsung Electronics produces TVs at its Kaluga plant near Moscow, and LG Electronics produces home appliances and TVs at its Luzha plant outside Moscow. Hyundai and Kia Motors operate a plant in St. Petersburg, while KT&G, Faldo and Orion also operate near Moscow.

According to a special report published by ETnews, the ongoing Russian-Ukrainian war is taking a toll on Korean companies with a presence in the region. Although key manufacturing sectors including smartphones, home appliances, and automobiles are exempt from the US Foreign Direct Payments Regulations (FDPR) export controls aimed at Russia, South Korean companies are still impacted by the disrupted supply chain.[19]

The war also disrupted preexisting trade infrastructure—in March 2022, Samsung Electronics had already suspended shipments of its products to Russia, citing logistic difficulties. In addition to shutting down factories, some companies have had to cut staff. Many Korean companies, however, are not considering completely pulling out of local factories and entities. They are enduring the accumulating damage and waiting for news of the end of the conflict and the resumption of exports.

Samsung and LG Electronics

Shipments of products and parts were halted when the Russian-Ukrainian War began, and Samsung, which has a TV and monitor production plant in Vorsino, Kaluga Oblast, Russia, shut down operations early last year when it ran out of stock. As a result, local distribution channels have been selling off their remaining inventory until the first half of last year, leaving them with nothing to sell.[20]

Samsung’s once-number-one smartphone market share in Russia has fallen to zero. The company lost its share after the outbreak of the Russian-Ukrainian war when it suspended shipments due to logistic disruptions and possible US sanctions. The void left by Samsung Electronics was filled by Chinese companies Xiaomi and Huawei, which once dominated the Russian market.[21]

LG Electronics, which was the No. 1 manufacturer of major home appliances such as washing machines and refrigerators in Russia, also stopped supplying products in March last year and shut down its factory in August. About 800 billion won was invested in the LG Electronics factory and corporation in Luzha, Moscow Oblast.

Electronics companies have been operating local subsidiaries to stay afloat as it may be difficult to reenter the country even if the war ends. They are on “standby” to identify procedures for resuming exports with the Strategic Materials Management Agency and implement them as soon as the war ends.

For electronics companies, Russian production facilities are important not only for local sales but also for products destined for the neighboring Commonwealth of Independent States (CIS) and beyond. For Samsung and LG, which have spent decades establishing themselves as national brands in Russia, there is no option of pulling out.

Hyundai

Hyundai Motor Group is one of the most willing Korean investors in Russia. It has the most local subsidiaries (18) of any Korean company. However, Hyundai’s sales in Russia totaled only 800 units in the first quarter of this year. It sold 200 units in January, 250 units in February, and 350 units in March. Compared to the first quarter of last year (35,520 units), the total is embarrassing (down 97%).[22]

Hyundai Motor Group has a 230,000-unit-per-year plant in St. Petersburg, but it shut down in March last year and stopped exporting to Russia, so there were no cars to sell. Its market share has now plummeted to single digits, despite being Russia’s number one imported car seller.

According to a report in May 2023 on BuyRussia21, a news outlet for Korean disputes in Russia, Hyundai Motor Group is looking to sell the St. Petersburg plant. Unlike Western automakers, the plan is to sell the plant to Hyundai’s joint venture in Kazakhstan (Astana Motors) and turn it into an export hub for CKD (Completely Knocked-Down) cars.[23]

In a nutshell, CKD is a production method in which many of the parts needed to produce a complete car are first partially assembled, then exported to another country to be fully assembled there. It is a popular method for exporting cars to developing countries. Hyundai and Kia also use the CKD export method, which involves sending chunks of partially assembled car parts (semi-finished products) from Korea to Kazakhstan to be fully assembled locally. Therefore, the sale of the St. Petersburg plant will shift the base of CKD exports to Kazakhstan.

Although the plant has been shut down for more than a year, Hyundai’s “Plan B” is to make semi-finished automobiles for CKD export by sourcing scarce parts from South Korea and Turkey to send to Kazakhstan to be assembled into finished vehicles. Since there are parts complexes such as Hyundai WIA, an engine production plant, in the vicinity, it is expected that there will be no major difficulties in the operation of plan B.

Hyundai WIA’s Russian plant is also “closed.” Not surprisingly, Hyundai’s production line has stopped. Hyundai WIA said: “We run the factory with the concept of occasionally greasing the machine.” However, there have been rumors that Hyundai Motor Group’s aims to restart the plant. Hyundai WIA is reportedly still maintaining its production workforce through paid leave and shift work.[24]

According to a report published in May 2023, Hyundai posted a net loss of 2.932 billion won in the first quarter of 2022 due to the plummeted utilization of its St. Petersburg plant.[25]

In March 2022, Hyundai closed its St. Petersburg plant. Local media reported that Hyundai’s assembly production was continuing at Avtotor in Kaliningrad, a Russian offshore territory, but Hyundai denied such an allegation. In May 2022, it was reported that Hyundai’s automobile assembly department at Avtotor went on a paid vacation.

In early 2023, Hyundai Motor’s Russian plant began layoffs due to reduced production in the wake of the prolonged war and supply chain disruptions. According to local media, Hyundai Motor’s production unit in St. Petersburg, Russia’s second largest city, announced that it had entered a phase of workforce optimization in Russia as production continues to be suspended. The company did not disclose the size of the layoffs.

Hyundai explained the reasoning behind the layoffs in a letter to local employees late last year, saying, “The company has been going through a very difficult period due to the disruption of parts supply caused by the global supply chain disruption, and even as the year comes to an end, there is still no restoration of the supply chain or resumption of production.”[26]

Kia

Kia has been taking advantage of the “parallel imports” authorized by the Russian government. Parallel imports refer to “goods that are imported into a market without their manufacturers’ consent.” They are authentic goods, but they may be “meant by the manufacturer to be sold in a different country or region.”[27] In May 2022, Russia released a list of Western goods eligible to be imported under the parallel imports scheme.

The Russian scheme “offers importers protection from civil suits for bypassing official distribution channels, and much of the unauthorized imports into Russia are coming via post-Soviet countries like Kazakhstan, Armenia and Belarus.”[28]

In March 2022, Hyundai shut down operations and exports from its St. Petersburg plant in response to Western sanctions against Russia, and it has been relying on local inventory sales. In August and September, when the inventory was nearly exhausted, the company recorded zero sales for some models.

However, Kia has seized on an opportunity provided by the parallel import schemes to circumvent the sanctions and enter the Russian market, and it is believed that the company seized the opportunity by securing an assembly production facility in northern Kazakhstan in December 2022.[29]

In Decembers 2022, Kia Motors’s assembly plant for the Sportage SUV in Kazakhstan opened.[30] The plant, located in Kostanay Oblast in northwestern Kazakhstan on the border with Russia, produces the Sportage using the CKD assembly method. Kia’s decision to build a plant on the Russian border, and specifically a Sportage assembly plant, is ultimately aimed at the Russian market.[31]

Kia Sportage remains one of the best-selling cars in Russia. According to local automotive media, the Kia Sportage remained the top-selling Korean car in Russia in November. Although sales dropped by half from 1,593 units in November 2022 to 781 units in November 2023, the Sportage retained the top spot, according to local media.

Steel and Petrochemical Industry

South Korea’s petrochemical industry[32] was hit hard by the Russia-Ukraine war. Petrochemical companies produce ethylene by pyrolyzing naphtha (NCC). Since the war began, the ethylene spread fell below the break-even point of US$300 per ton in April last year and hovered between $100 and $200 per ton by the end of the year. Production and profitability deteriorated simultaneously.[33]

Export sanctions on Russia, the world’s top natural gas producer and third largest oil producer, have pushed up international hydrocarbon prices including for oil, which in turn have pushed up the price of naphtha, which is refined from crude oil. Demand for petroleum products has also slowed due to the global economic contraction.

Domestic petrochemical companies have taken steps to accelerate and extend turn-arounds, whereby the entire process unit of an industrial plant is taken off stream for an extended period for revamp and renewal. The more ethylene they produce, the more they lose. In fact, Yeochun NCC, the country’s third largest petrochemical company after LG Chem and Lotte Chemical, extended its 370,000-ton capacity turn-around, which was scheduled to end in December 2022, by two months. LG Chem completed its turn-around at its 1.18 million-ton Yeosu NCC plant in late 2022.

Korea’s domestic steel industry has also been hit. Although the share of steel products traded with Russia and Ukraine is not large, it has been affected by the slowdown in steel demand in the wake of the global economic slowdown.

According to the Korea Iron and Steel Association, Korea’s annual crude steel production last year was 65.64 million tons, down 6.8% from 70.41 million tons the year before. The decline was even more pronounced in the second half of the year. The rate of output decline, which was in the single digits until August last year, widened to 15.3% in September, 11.1% in October, 17.6% in November, and 11.7% in December. Steelmakers are reportedly responding by diversifying their imports of scrap (raw materials), which account for about 12% of imports from Russia.

Agriculture

Korean companies that produce corn, soybeans, oats, and potatoes in Ussuriysk, Yeonju, for export to South Korea or for local sale, said they are facing difficulties in maintaining agricultural machinery for sowing in the aftermath of the crisis in Ukraine.[34]

Some companies had planned to plant corn, soybeans, and other crops this year at a similar level to last year, but their plans were disrupted because they were unable to obtain parts in time to maintain their farming equipment, including tractors and tillers produced in Russia and other countries.

“Overseas manufacturers of agricultural machinery withdrew from Russia after the crisis in Ukraine, and the delivery period for parts, which used to take one to two months, has increased to three to four months,” said a company representative, adding, “As a result, we are facing difficulties in maintaining agricultural machinery in time for sowing crops.”

Shipbuilding and Construction

Sanctions have also made it difficult for shipbuilders to bring parts and materials needed to build ships into Russia.[35]

At the Zvezda shipyard in Bolshoi Kamen, a small city in Primorsky Territory, three South Korean shipbuilders, including Samsung Heavy Industries [010140] and Hyundai Samho Heavy Industries, are building crude oil carriers and liquefied natural gas (LNG) carriers to supply the Russian side.

Of these, Samsung Heavy Industries signed a contract with Russia in late 2019–2020 to supply 15 LNG carriers for the Northern Sea Route (NSR) in three phases.

Currently, Samsung Heavy Industries is building the ships by importing domestically produced ship blocks, parts, and materials to the Zvezda shipyard for the first phase of the project, which will supply five LNG carriers first.

However, in 2022, the company faced difficulties in procuring materials as ships, offshore systems, and equipment exported to Russia were included in the 57 nonstrategic items that require export licenses from the South Korean government.

In December last year, the Korean government approved the import of parts and materials requested by Samsung Heavy Industries, and the company has now secured the materials needed for the first phase of the project, but it is unclear whether it will proceed with the second and third phases.

In the years leading up to the outbreak of war in Ukraine, the three shipbuilders that announced orders for large shaving LNG carriers were grappling with an “invisible risk.” Although they have not directly announced the orders, they are backed by major Russian shipping lines aiming to operate on the Arctic route. In particular, orders for large LNG carriers from Russia have increased significantly as LNG conversion plants have been built at gas fields in Siberia’s Yamal Peninsula.

According to a report by Maeil Business News in November 2022, Samsung Heavy Industries is in the process of building only three of the 20 ships ordered by Russian customers. [36] The other 17 ships were stopped before they were even designed. Even for the three ships that are in the process, the remaining $250 million of the $860 million price tag is still outstanding.

Hyundai Heavy Industries and Hanwha Ocean are reportedly in the same boat as Samsung Heavy Industries. In June 2020, Daewoo Shipbuilding & Marine Engineering won an order for two LNG barges from Novatek, a Russian private gas company leading the development of the Yamal Peninsula gas field (Yamal Project), and it has been working hard to win orders for icebreaking LNG gas carriers.

Like the shipbuilding industry, the construction industry, which has received only a small number of orders, is also feeling uneasy. According to the Overseas Construction Information Service, domestic construction companies’ orders in Russia were not large, including $3.41 billion in 2018, $328 million in 2019, $118 million in 2020, $1.78 billion in 2021, and $1.62 billion in 2022.[37]

Even in 2018, when it exceeded $3 billion, it was only 10% of the total $32 billion in overseas construction orders won by the Korean construction industry. In 2014, Hyundai recorded the largest order with $5.64 billion, when the total amount of overseas construction orders was $66 billion.[38]

Hyundai Engineering won a $3 billion petrochemical facility order from Russia’s Newstream JSC in 2018 and a $75 million gas processing facility order in 2021, but both were canceled due to the client’s circumstances. There are currently no ongoing projects.

Before and after the war, DL E&C (formerly Daelim Industries) won a $1.24 billion contract in 2021 and Samsung Engineering won a $1.14 billion contract in 2022. The client is the same, the Baltic Chemical Complex. The two companies said there have been no major incidents at the construction site to date. Fortunately, the risk of external factors is low as only design (E) and purchase (P) are in charge of the EPC project, which consists of design, purchase, and construction.

In particular, in February, Samsung Engineering disclosed that it changed its contracting method with clients from the lump sum method to a combination of lump sum and convertible methods. The lump sum contract requires the contractor to bear all unexpected costs, but the convertible contract reduces this burden.

Some remain concerned about the prospects of participating in postwar rehabilitation projects and working with established Russian energy companies such as Gazprom, Novatek, and large projects such as the Baltic Chemical Complex. This is because the uneasy relationship between the two countries could block the way for already awarded FEEDs to lead to subsequent EPC work. DL E&C has been awarded two FEEDs in 2021 and has several contracts with Gazprom.

Key Shipbuilding Contracts

Telecommunications

Korea is a growing player in the telecommunications sector, and it has sought an increased role in the Russian economy. This was encapsulated by Korea’s KT plans to build an internet data center (IDC) in Russia. According to the telecommunications industry, KT notified the Russian authorities in mid-April to liquidate its KT Yanzhou (Primorye) IDC entity. The liquidation period is until April 3, 2024. In the meantime, the situation may improve—such as with the end of the war in Ukraine—but otherwise, the IDC will not be built.[39]

In February 2022, KT signed a memorandum of understanding (MOU) with Russian telecommunications company Mobile Tele Systems (MTS) to cooperate and jointly build a local IDC based on its successful experience in the telecommunications business in Yeonju. It announced that it would pursue cooperation projects such as technological cooperation on AI-based video and voice solutions, media content exchange, and securing intellectual property.

Following this, last May, KT established a corporation in the Russian Federation to handle the IDC business. The prolonged war made it difficult to carry out normal business, and it entered liquidation after about a year. KT said, however, that it is not liquidating the entire entity in Russia. “The liquidation of IDC is a decision based on various environmental factors,” KT said, “and we will continue to review various options for global business development.”

Another Korean telecommunications company was also significantly impacted. POSCO International, which has offices in Moscow and Vladivostok, has reportedly drastically reduced its local workforce in Russia. The status of the Vladivostok office was also lowered to the level of a liaison office. There are no expatriate staff and only two locally recruited employees. The Moscow office also has only one expatriate and three local recruiters. POSCO International has now suspended all transactions with the Russian side.

As the Korean government announced on March 28 that it will ban the export of 741 additional items to Russia, including machinery, automobiles, and chemicals that can be diverted for military purposes, the business of trade mediation companies (formerly known as general trading companies) such as POSCO International is expected to shrink further.

Electronics

Samsung Electronics and LG Electronics have invested heavily in developing the high-growth Russian market for their smartphone, home appliance, and TV and display businesses. In March 2019, Samsung Electronics topped the list of “100 brands with the Best Customer Experience in Russia” released by global consulting firm KPMG.[40]

However, since the outbreak of the war, the companies have virtually halted factory operations and sales at their Russian subsidiaries.

Samsung shut down its TV and monitor factory in Kaluga Oblast, near Moscow, in March last year. LG Electronics also shut down its factory in Luzha, outside Moscow, which makes home appliances and TVs, last August.

According to market research firm Statista, Samsung’s sales in Russia reached 307 billion rubles ($5 trillion) in 2020 and 361 billion rubles ($5.87 trillion) in 2021. The company also posted a net profit of 93.53 billion won in 2021, compared to a net loss of 48.9 billion won last year. The war in Ukraine turned it into a loss-making company in one fell swoop.

Its market share has also plummeted. According to market research firm Counterpoint Research, Samsung’s share of the Russian smartphone market fell from 35% in 2021 to 2% in December 2022.[41] The share of Chinese brands such as Xiaomi soared from 40% to 95% over the same period. [42] The market shift came as the company suspended shipments of products and parts to Russia from March last year and shut down local factories.

In 2021, the year before the war, LG’s sales in Russia and its neighboring countries totaled 2.35 trillion won, according to the company’s business report. That was 2.7% of LG’s total sales that year, a growth rate of 22% from the previous year (2020). However, last year, the Russian subsidiary’s revenue was halved to 94.5 billion won, and it posted a net loss of 23.2 billion won. Like Samsung Electronics, it turned a loss.

An electronics industry official said, “Withdrawal is not an option, as it would take astronomical time and money to reenter the Russian market,” but added, “The sense of crisis has increased due to unexpected bad news such as President Yoon’s foreign press conference.” Maintaining local trading lines and managing customers in preparation for the resumption of business is the best course of action for now.

Food

It is no exaggeration to say that “K-food” has become a “legend” in the Russian market over the past 30 years. The cup noodles Dosirak and Choco Pie are representative. Faldo, Orion, Lotte Wellfood (formerly Lotte Confectionery), CJ, and others are expanding Korean flavors in Russia. Based on their long experience and business strategies, they have established factories and actively implemented localization strategies.[43]

As a result, even during the war in Ukraine, K-food has maintained a steady growth trend. On a humanitarian level, it cannot be ignored that the West did not impose sanctions on medicine, food, and some necessities.

Introduced to the Russian market in 1993, Orion’s Choco Pie is now a local favorite. The company has diversified its flavors to 14 varieties and expanded its production line with three factories resulting in strong sales in the past year. Orion’s sales in Russia reached KRW 209.8 billion, up 79.4% from the previous year (2021).

“We entered the local market a long time ago and have established ourselves as a domestic company, so we were not affected by the war,” said an Orion representative.

Faldo, which introduced the cup noodle “bento” to Russia in 1991, long before Choco Pie, boasts a dominant share (60%) of the local containerized noodle market. Last year, Faldo’s Russian subsidiary generated sales of six types of bento, up 2.9% from the previous year (2021). In October last year, Faldo acquired the Russian business unit of Spanish global food company GB Foods for tens of billions of won.

“The instant noodle brand called Bento has become a national brand in the country,” said a Faldo official, adding, “We are not taking the current situation seriously.”

Lotte Wellfood’s sales in Russia rose 53% last year. With the local business doing well even during the war, Lotte Wellfood invested 34 billion won in its Russian subsidiary earlier this year to expand its Choco Pie production line and warehouse.

Pharmaceutical and Biotech

Due to the COVID-19 pandemic, Korean pharmaceutical and biotech companies’ cooperation with Russia took a major turn. The scope of cooperation has been broad and diverse, including the domestic outsourcing of Russia’s coronavirus vaccine Sputnik V, the initiation and expansion of clinical trials in Russia, the mass export of rapid coronavirus tests, and the export and technology transfer of existing medicines. However, there is a risk that the coronavirus pandemic will subside and the outbreak of war will block the path of exchange cooperation and export. Pharmaceuticals, on the other hand, are exempt from Western sanctions on Russia for humanitarian reasons.[44]

Korean pharmaceutical companies with a presence in Russia include Il-Yang Pharmaceutical, Dong-A Socio Holdings, Hanmi Pharmaceutical, Huonce Biopharma, Isuapps, and Crystal Genomics. They have started by exporting and licensing medicines and transferring technology to local companies.

In 2014, Il-Yang Pharmaceutical signed an exclusive sales agreement with Russian pharmaceutical company Alpharm for leukemia treatment Radotnim/Supect and in 2016 for reflux esophagitis treatment Noltek. Alpharm is Russia’s top pharmaceutical company with annual sales of 1.8 trillion won. It is said to comply with European guidelines for drug manufacturing, clinical trials, and sales and marketing.

In 2017, Dong-A Socio Holdings signed a strategic partnership with Russian pharmaceutical company Farmachinez. Since 2011, the company has been trading with Farmachinez for its TB drugs Cycloserine and Terizidone and hangover remedy Morning Care, a relationship that has continued in the aftermath of the full-scale invasion of Ukraine and the introduction of sanctions. In addition, the company plans to transfer technology for some items. Parmachinez is one of Russia’s top 10 pharmaceutical companies, specializing in the production and sale of anti-tuberculosis drugs, antibiotics, and AIDS drugs.

Parmachinez has also collaborated with Russia’s Isuapps. In 2020, the two companies signed a technology transfer agreement for ISU305, a biosimilar candidate for Soliris. Last year, the company also transferred its rare disease drug Pavagal to local pharmaceutical company Petrovax. Earlier this year, the company also agreed to transfer Alpharm and ISU106, a biosimilar of immune gateway inhibitor Opdivo.

In 2021, Hanmi Pharmaceutical obtained Russian approval for AmoxaltanQ (Russian name Tristinium), a three-drug combination for hypertension and hyperlipidemia, through its local partner Sanofi. Sanofi will be responsible for marketing and sales in Russia.

Last year, Huonce Biopharma received a license from the Russian health authorities for its botulinum toxin product HUVOTOX (Riztex). It is promoting local entries under the name of Novacutane BTA through Russian aesthetics company Institute of Beauty Fiji.

In March, Crystal Genomics sent an initial batch of 1.8 million capsules of Aselex for osteoarthritis to PharmAtis International in Russia. PharmAtis International plans to officially launch Aselex in Russia as soon as possible after establishing a sales and marketing strategy.

Korean Government’s Efforts to Remedy the Impacts of Financial Sanctions

It is notable that, while implementing hefty sanctions on Russia, the South Korean government is also proactively seeking to minimize adverse impacts on its own citizens and companies.

The Korean government’s financial sanctions on Russia were accompanied by separate measures to remedy adverse impacts on Korean expatriates in Russia. On March 18, 2022, the South Korean government announced that it plans to temporarily operate a payment system for exports and imports to and from Russia through Hana Bank and Woori Bank, which have legal entities in Russia.[45] The South Korean government also decided to increase the amount of money that can be quickly sent to Korean citizens and students living in Russia through diplomatic channels from $3,000 to $8,000. This is a system that allows Korean citizens to deposit money into a foreign ministry account in Korea and receive it in local currency at embassies and consulates when they need money due to an unexpected accident abroad.

Financial authorities have also decided to simplify bank loans to domestic family members of expatriates involved in the Ukraine crisis. Some banks have been reluctant to lend to expats due to lack of regulations on how to verify overseas income documents.[46] As a result of the financial authorities’ inspection of major difficulties from companies, it was found that transactions involving non-sanctioned banks and non-sanctioned items were frequently delayed or rejected due to global intermediary banks’ avoidance of transactions involving Russia. “Remittances from South Korea to Russia can still be sent through non-sanctioned banks, such as local subsidiaries of Korean banks in Russia,” the Financial Supervisory Service and the Ministry of Land, Infrastructure, and Transport said.

In April 2022, Korea’s Ministry of SMEs and Startups and the Small and Medium Business Administration (SMBA) announced that they would support exporting SMEs affected by the crisis in Ukraine to find alternative trading lines.[47]

According to the MOTIE, the government has been supporting Korean companies operating in Russia through the Russia Desk, an export control consultation center, since the outbreak of the Russian-Ukrainian war last year.

Financial authorities and the Korea Trade Insurance Corporation (K-Sure) have been supporting importers, exporters, and local companies over the past year by expanding liquidity and diversifying export lines.

The Korea Development Bank and the Export-Import Bank have launched emergency financial support programs totaling KRW two trillion for affected companies. Last year, K-Sure invested KRW two trillion in support for the supply chain crisis and KRW 67.6 billion in special support for companies affected by the Russia-Ukraine war.

The Korea Trade-Investment Promotion Agency (KOTRA) is providing emergency logistics support to companies facing difficulties in local logistics and sharing information on the status of local port controls. It also provides storage space and inland transportation services to local logistics centers that have signed agreements with KOTRA.

Trade associations and the Financial Supervisory Service have been collecting and compiling information on the status and trends of business difficulties and are continuing to discuss countermeasures with relevant organizations.

However, companies are facing structural difficulties. In particular, Russia’s exclusion from the Society for Worldwide Interbank Financial Telecommunications (SWIFT), which restricts financial transactions by Russian banks, and the devaluation of the ruble have led to delays in payment or failure to collect payments from Korean companies.

According to the Ministry of SMEs, as of November 2022, cases related to non-recovery of payments accounted for more than 60.8% of the total damage. Reduced exports due to suspended or canceled contracts and deliveries accounted for 19.5%, logistics delays and disruptions accounted for 7.3%, and import payments due to surging raw material prices accounted for 5.5%.

According to the Russian Ambassador to South Korea Andrey Kulik, the South Korean government directly told Moscow that it does not want Korean companies to withdraw from Russia.[48]

In 2023, the South Korean government continues to endorse Korean businesses in Russia. As recently as in June 2023, the Consulate General of Korea in Vladivostok organized an event to identify the difficulties faced by Korean companies in the Far East and to find ways to support them.[49]

Unexpected Financial Benefits of the Sanctions for Korean Banks in Russia

Two major South Korean bank subsidiaries are operating in Russia: Woori Bank and Hana Bank. One year into the war, it was expected that Woori Bank’s and Hana Bank’s business in Russia would suffer as local companies shut down factories and reduced bilateral exchanges. However, Korean banks in Russia have turned out to be unexpected beneficiaries of the financial turmoil.[50]

Woori Bank was the first Korean bank to establish a Russian subsidiary in January 2008. As of the end of 2022, the bank operated two branches in Moscow and St. Petersburg and one office in Vladivostok. Hana Bank opened its Russian subsidiary in September 2014.[51]

Woori Bank’s Russian subsidiary generated 36 billion won in operating profit and 12 billion won in net profit last year. Total assets also increased by more than 50%, from KRW 522 billion at the end of 2021 to KRW 786 billion at the end of last year. Hana Bank Russia’s operating profit last year was 16.3 billion won, up 158% from the previous year’s 6.3 billion won, and net profit was 13.9 billion won, up 148% from the previous year’s 5.6 billion won. Total assets increased 66% to 1.28 trillion won from 725.6 billion won over the same period.[52]

As Russian banks were subject to Western sanctions, Woori Bank’s and Hana Bank’s Russian subsidiaries, particularly after the latter explored alternative payment networks separate from the SWIFT system given its restrictions on Russia’s banking system.[53] In addition, investment income increased significantly as the Russian central bank significantly raised the key interest rate. Russia’s benchmark interest rate rose to a whopping 20% in February last year and is currently hovering around 7%.[54]

However, the prolonged war has also deepened the worries of Woori Bank’s and Hana Bank’s Russian subsidiaries. “In response to the prolonged war, we are focusing on risk management rather than expanding the assets of our Russian subsidiary,” said a Hana Bank official.[55] “The purpose of establishing overseas subsidiaries is to provide financial support to domestic companies, expatriates, schoolchildren, and students in the country,” another official said, adding, “Even if the local situation worsens, banks are likely to be the last to go.”[56]

Korean Perception of Plummeting Russian Credit

According to K-Sure, which publishes about 50,000 credit reports on foreign companies every year, Russia is the country with the highest proportion of companies with “poor” (R-) credit ratings. As of last year, the proportion of Russian companies with a “poor” rating reached 45%. This is the ratio of all companies that received a poor (R) rating after rating or whose ratings were not available.[57]

The Trade Insurance Corporation also published a country-specific “credit risk index” based on companies rated “poor,” which excludes companies that did not submit sufficient data or whose ratings were withheld due to difficulties in verifying their submissions. Again, Russia ranked the highest of the 12 countries surveyed, at 43.1%. An increase in this index reflects an increase in the likelihood of nonpayment of trade transactions.

Many Russian companies have been subject to US economic sanctions following the war in Ukraine. The US designated 946 companies for sanctions associated with the Russia-Ukraine War last year. Sanctioned companies were rated as “junk.” This is the underlying reason why Russia’s “credit risk index” jumped nearly six times last year to 43.1% from 7.2% in 2021. The number of companies subject to economic sanctions in Russia increased more than 12 times year-on-year last year, and the exclusion of major banks from the SWIFT system has made it more difficult than ever to transfer trade payments.[58]

South Korean Companies At a Crossroad: To Withdraw or To Stay

Most Korean experts argue that—despite the risks—economic cooperation with Russia should not be completely cut off.[59] “Russia is strong in basic science,” according to Min-hyun Jung, head of the Russia and Eurasia team at the Korea Institute for International Economic Policy. “It can create synergy with (South) Korea,” he elaborated.[60]

However, Korean companies cannot easily decide to withdraw while watching the exodus of Western companies because they cannot give up the Russian market, which is connected to Eastern Europe and Central Asia. The threshold for entering the market is also high, and once a company is out, it is astronomically expensive and time-consuming to reenter.[61]

The past experience of holding out was also useful as a learning effect. When global companies such as Sony withdrew from Russia during the 1998 moratorium declaration, South Korean companies including Samsung Electronics actually expanded their business, laying the foundation for becoming Russia’s national brand In 2014 and 2015, when the Russian economy fell to the bottom due to Western sanctions against Russia following Russia’s annexation of Crimea and a drop in international oil prices, GM in the US and some European automakers closed their plants or pulled out, but Hyundai remained in the market until the end. As a result, Hyundai Kia’s local market share rose to No. 2 overall and No. 1 among imports.

The problem is that the war is lasting longer than originally expected. Chinese companies have been quick to take over while Korean subsidiaries and factories have been shut down. And they do not have a plan B, which only adds to the headache. Representatives from companies with local presence can only say that they are “monitoring the situation closely.” They do not want to talk about it.

Competition Between Korean and Chinese Companies in the Russian Market

Automobiles

A report published in March 2023 by Pressian, a Korean media company, contended that “Chinese automakers flooded the Russian market” to fill in the vacuum left by German cars.[62] Kia and Hyundai were previously popular among the middle class, but Russia is “getting used to life without Hyundai and Kia.”[63]

South Korea had the largest share of the Russian auto market in 2018. However, Kia and Hyundai, which produced and sold more than 200,000 vehicles a year, quickly disappeared from the Russian market in 2022 with the imposition of economic sanctions. Volvo Cars and Volkswagen have also decided to stop selling cars in Russia. With all Western companies “banned from producing and importing cars,” Russia was expected to face a shortage of new vehicles. In April 2022, car sales dropped by more than 75% year-on-year.[64]

Chinese automobile companies rushed to fill the void. In early 2023, a number of Chinese automakers flooded the Russian market: Changan, Chery (Exeed, OMODA, Jetour), Yiqi (FAW), Jianghui (JAC), Dongfeng Motor Corporation (DFM), Guangzhou Automobile (GAC), Geely (Livan), Great Wall (Skywell, Tank, Haval), Hongqi, Dongfeng Automobile (Voyah). This is a huge change from 2021, just two years ago, when Chinese automakers such as Haval, Chery, Geely, and Changan sold less than 80,000 vehicles in Russia. The same year, Kia and Hyundai sold 300,000 vehicles in the country. In 2018, Chinese cars accounted for just 2% in the Russian automobile market. By the end of 2022, the share climbed up to 30%. The Pressian report estimated that, at this rate, the share of Chinese cars in the Russian market is expected to reach 40% by the end of 2023.[65]

According to a report by Nikkei Asia, during the first five months of 2023, “China’s Great Wall Motor and Geely captured second and third place, respectively, in terms of sales volume in Russia’s auto market.” Meanwhile, “Kia has sunk to seventh place while Hyundai ranked 11th.” Other industries are also facing similar phenomena:[66]

In March, the average price for South Korean-made TVs jumped by about 20%, according to Russian media reports. To Russian consumers, the less-costly Chinese options look attractive.

When it comes to smartphones, a big factor is the ability to use payment apps from Russian financial services with the same functionality as before the sanctions. During the first half of the year, Chinese mobile phone manufacturers commanded over 70% of the Russian market, according to M.Video. More Russians are reportedly choosing Chinese products due to the level of convenience offered.

“This is a situation where Chinese manufacturers do not have to do anything for their shares to climb,” said Naoya Hase, head of the Moscow office for the Japan Association for Trade with Russia & NIS.

Home Appliances

Similarly in the home appliances market, Chinese firms have been replacing Korean items. LG has long been a very popular brand in Russia for its home appliances—in 2021 the company dominated the market. In 2022, however, China’s Haier took the top spot, and by 2023, Korean-made home appliances were rarely seen in Russian stores. The Pressian report contended that “there is no shortage of consumer and industrial goods produced in Russia and China on store shelves … Russians are getting used to life without Apple and McDonald’s, Kia and Hyundai, LG and Samsung.”[67]

When Russia declared a moratorium in 1998 and Japanese and European companies left the Russian market, many Korean companies stayed behind. In the aftermath of the 2008 Global Financial Crisis and the 2014 Western sanctions on Russia, Korean companies also continued operations. The report noted that such a positive track record helped Korean companies not only earn unrivaled market share in the long run but also “gain the Russian consumers’ trust.”[68] However, in 2023, especially with Chinese companies quickly replacing South Korean companies in Russia, “it’s harder to win back a market once lost than it is to make new ones.”[69]

A report by The Korea Times in April 2023 also noted that an executive at a Korean conglomerate with operations in Russia worried that “it is virtually impossible for foreign companies to return to the Russian market”: once they pull out.[70] In an interview with this report’s author, Hyomin Park, a partner at the Korean law firm Shin & Kim who has advised South Korean companies operating in Russia, noted that Korean businesses are resigned to the fact that they may never recover lost market shares. This could be the case even if they decide to maintain Russia operations, as many of them are “unable to exit not because of long-term assessment of recovery but because of the technical difficulties and hurdles imposed by the Russian government.”[71] In fact, some businesses are concerned that they might get nationalized by the Russian government should they linger in the market for too long.

IT Products

The impact of sanctions on Russian technology results from restrictions that Korea and the wider West have imposed but also from Russian countermeasures even for companies that remain in Russia. For example, Samsung has maintained a presence in Russia since the full-scale invasion, but it is facing recent setbacks from the Russian government’s regulations.[72] Throughout 2022, Samsung Electronics exported TVs and other home appliances by producing them at its Kaluga plant in Russia and sending them to the Eurasian Economic Union (EAEU), a group of Russia and four other ex-Soviet countries (Belarus, Kazakhstan, Armenia, and Kyrgyzstan), and then bringing them back to Russia for sale through parallel importation. Samsung has a 3.2% share of the Russian TV market, with an estimated annual sales revenue of 60 billion rubles.

The Law on Parallel Imports, signed by Putin on March 28, 2022, allows for the importation of goods into Russia without obtaining permission from the original manufacturer (patent and trademark holder). In the case of Samsung smartphones, for example, anyone who applies for an import license is legally allowed to import them, regardless of whether they were produced in a Samsung factory or exported directly to Russia.

In May 2022, Russian authorities limited the number of products that could be imported in parallel to 200 brands across 50 items, including smartphones, other IT, and home appliances. Samsung was included on this list. The Inventive Retail Group (IRG) in Russia operated the Samsung distribution network on behalf of the company. In June 2023, however, local media reported that the Digital Ministry was discussing a ban on parallel imports of computer and IT products, including servers and data storage devices, from “unfriendly countries”—a list which includes South Korea. Western companies such as Acer, Asus, MSI, IBM, Dell, and HP are among the brands expected to be included in the parallel import ban, totaling more than 20 items. Samsung is also potentially a target.

The same month, the Russian government reportedly discussed excluding Samsung smartphones from the parallel import list. According to local Russian media outlets such as RBC and Kommersant, Russian Digital Minister Maksut Shadayev announced that the Russian government is “pushing for a ban on parallel imports of Samsung and LG smartphones (LG stopped production in 2021, before the war).” Despite the “rerouting” from EAEU countries, Samsung’s “official” exports to Russia plummeted since the Ukraine War. The Russian smartphone market has been dominated by Chinese brands such as Xiaomi and Huawei for the past year. The move to ban Samsung from parallel import could be a critical blow.

Critically, this speculation came with the backdrop of Chinese companies’ increased presence in the Russian market. The Russian Digital Minister explicitly discussed “the presence of Chinese brands” to explain the decision. Fears of a smartphone shortage were high when Apple and Samsung stopped shipping products to Russia in March 2022, but fears were eased by the influx of Chinese brands. Russia’s No. 1 carrier, MTS, told state-run news agency TASS that the ban on Samsung smartphones is unlikely to have a significant impact on the Russian smartphone market as consumers have shifted to Chinese brands over the past year. In August 2023, South Korean media reported that Samsung will remain on the parallel import list for the time being according to TASS.[73] However, concerns remain to what extent Samsung can retain its presence amid expanding Chinese market share.

According to market research firm Counterpoint Research, “At the end of 2021, before the war in Ukraine, Samsung Electronics (35%) and Apple (18%) held the first and second positions in the Russian smartphone market, respectively, but their shares plummeted to 2% and 1% in December last year, while Chinese smartphone makers such as Xiaomi expanded their market share to 95%.”[74] Domestic Russian companies also allegedly lobbied for the bans, citing “the continued presence of high-quality imported equipment on the market” as “detrimental to technological development and production.”[75]

South Korean Dependence on Russian Energy

Although it has not received the attention that more prominent Russian energy-dependent Western countries like Germany have received, South Korea also has valuable lessons for how the transition away from Russian energy dependency in the aftermath of sanctions has played out.

In 2021, 73% of South Korea’s imports from Russia consisted of fossil fuels.[76] Russia was South Korea’s fourth-largest source of fossil fuels, but this accounted for only 9% of South Korea’s total energy imports. Crude oil and natural gas have relatively modest shares of fossil fuel imports at 6% and 5% respectively, but others claim a larger share.[77] In 2021, Russia supplied 41% of South Korea’s imported anthracite coal, 23% of naphtha, and 16% of bituminous coal.[78]

According to a report published by the Korea International Trade Association (KITA) in June 2022, South Korea’s dependence on Russian coal surpassed the 20% mark after the full-scale invasion of Ukraine.[79] This is in contrast to the EU, Japan, Taiwan, and others, which have reduced their dependence to less than 10% by reducing their imports of Russian coal. The prolonged Russian-Ukrainian War could put pressure on the domestic industry if the Kremlin takes further retaliatory measures.

“Since March last year, the price of coal from Europe and Australia has increased significantly, but the price of coal from Russia has decreased, widening the price gap,” said the Kia, continuing that, “it is analyzed that domestic companies have increased imports of cheap Russian coal.” The port of Vostochny, a major Russian coal export port, is located close to Busan, allowing for quick transactions and relatively low sea freight costs, which has been a major factor in the increase in Russian coal imports.

If Russia controls the supply of energy raw materials, international commodity prices could rise and affect South Korean industry. After Russia’s invasion of Ukraine in late February last year, international oil prices rose sharply, as did natural gas and coal prices, increasing the cost burden on South Korean companies. A 10% increase in the price of energy raw materials, including coal, is estimated to increase the average production cost of all Korean industries by 0.64%. The cost burden is expected to be particularly high for petroleum products (5.92%); electricity, gas, and steam (4.74%); primary metal products (0.96%); and chemical products (0.93%).

Deteriorating South Korea-Russia Political Relations

Crucially, these phenomena come in the context of deteriorating South Korea-Russia relations. Since the beginning of the Ukraine War, the bilateral relations have headed for a downward spiral.

As the Russian ambassador to Seoul Andrey Kulik himself summarized in June 2023:[80]

South Korea joined the so-called “first package” of sanctions against Russia in March last year. Since then, it has also joined financial sanctions against Russia and announced a list of products to be embargoed. The list has grown from 58 items last year to more than 700 this year. The high-level dialog between the South Korean and Russian governments has also been effectively suspended. Specifically, the Russo-Korean Joint Commission on Economics and Science and the Russo-Korean Forum on Regional Cooperation have been suspended. South Korea has also suspended direct flights to Russia.

In May 2023, the Wall Street Journal (WSJ) reported that “South Korea is transferring artillery shells for Ukraine.”[81] In April 2023, South Korean President Yoon noted that “South Korea might extend its support for Ukraine beyond humanitarian and economic aid if it comes under a large-scale civilian attack.”[82] The South Korean government’s official position is nuanced. Seoul maintains that “no 155mm artillery shells were directly supplied to Ukraine, nor were they diverted through Poland or moved to the US for the purpose of diverting them.” The South Korean government’s official position that it exported 100,000 155mm shells to the US but cannot confirm whether it loaned 500,000 to the US.[83]

Russian officials have warned against South Korea’s gradually pronounced support for Ukraine.[84] In March 2022, South Korea was included in the Russian government’s list of 48 “unfriendly countries.” [85] “We are aware of South Korea’s decision to supply arms and ammunition to Ukraine,” Russian President Putin said in October 2022.[86]

Russia has also hinted at potentially helping North Korea in retaliation, although it has not elaborated on the specifics. As of the date of writing, there has not been substantial evidence of Russia incentivizing North Korea to stir problems in the Korean Peninsula. However, there have been notable examples of consolidating Russia-North Korea partnership in the war. In December 2022, Reuters reported that the Wagner Group bought weapons from North Korea;[87] North Korean workers are also set to be dispatched to eastern Ukraine under Russian occupation.[88] In 2023, this cooperation expanded significantly. After North Korean dictator Kim Jong Un met with Putin in Vladivostok in September 2023, North Korea shipped at least 1,000 containers to Russia, which according to Estonian intelligence, may have contained as many as 350,000 rounds of ammunition crucial to Putin’s war in Ukraine.[89] Russia was voting for sanctions against North Korea itself at the United Nations as recently as 2017, and it is all-but-certain that Pyongyang will expect future assistance in response. [90]

It is important to note that despite South Korean concerns that Russia might help North Korea to retaliate against South Korean sanctions and indirect arms assistance to Ukraine, the trend points more toward Russia buying North Korean weapons and workers for its own needs in Ukraine. Furthermore, although some Korean experts worry that the Russian government could retaliate against Korean companies, there is little evidence of such measures. In an interview with this report’s author, Hyomin Park, a partner at the Korean law firm Shin & Kim who has advised South Korean companies operating in Russia, noted that they are mostly cautious to not violate US sanctions—the Russian government has not imposed meaningful restrictions on Korean companies despite the political tension.

Ultimately, Russia, wary of further isolation, has been careful not to excessively antagonize South Korea. The Russian government maintains that South Korea and Russia are partners. Russian protests on South Korea’s policies explicitly accused “tremendous pressure from the US, EU, and NATO,” shifting blame away from Seoul itself. On the issue of ammunition sales, the Russian ambassador to South Korea strikingly acknowledged that “we have no reason to believe that South Korea has supplied arms to Ukraine.”[91] He blamed “Western sanctions against Russia” for “difficulties faced by Korean companies in Russia.”

In an interview with the Korean media, the Russian ambassador even suggested trading in rubles to bypass the Western financial system:[92]

If a national payment system is introduced, many problems between the two countries (Russia and Korea) will be solved naturally. It is also in line with the global trend for the two countries to trade in KRW and RUB… Russia already has a success story of trading in rubles. Today, most of the Russian-Chinese gas trade is conducted in rubles.

Nonetheless, South Korea is largely expected to join Western efforts to punish Russia and limit its capacity to conduct war in Ukraine.

In March 2023 Russia issued a new regulation stating that companies selling local assets must pay a mandatory contribution.[93] The compulsory contribution is 5 to 10% of the market value of the asset to be sold. The company’s decision to withdraw from the Russian market will also have a costly impact. Meanwhile, Korean companies are cautious to not antagonize the Russian government.[94]

A report released by the KITA in June 2023 predicted that, even if Russia takes retaliatory measures such as import and export restrictions, the negative impact will be limited.[95] This is because Russia accounts for only 0.9% of Korea’s exports and 2.1% of imports. However, the share of imports of radioisotopes, unalloyed pig iron, and ferrosilicon chromium (a core component in manufacturing steel) from Russia is more than 90%, suggesting that diversification of supply lines is necessary.

Why South Korea’s 2022 Response Differed So Significantly from 2014

The Korean government’s response to the 2022 Ukraine War is more sweeping than its reaction to Russia’s annexation of Crimea in 2014.

Overall, international sanctions imposed on Russia following the forcible annexation of Crimea in 2014 targeted financial services, key Russian businessmen, bureaucrats, and politicians, and were limited to the export of strategic goods. However, thanks to the rising prices of international commodities and the potential of the Russian domestic market, the effect of the sanctions was limited and the impact on Russian society was not significant.

In contrast, international sanctions on Russia post-2022 completely isolated Russian society from the West. Most Russian financial institutions were cut off from the SWIFT network, imports of Russian goods were banned, and economic activity by Western companies in Russia was suspended. The lack of access to the international banking network had a severe chilling effect on business activity, and the US and EU sanctions against Russia seemed to be working, unlike the 2014 sanctions.