A nation must think before it acts.

Introduction

This report is based on a chapter of my forthcoming book on the relationship between China and Russia. For the US, this is arguably the most important bilateral relationship in the world today. A robust, resilient partnership between Beijing and Moscow has the potential to remake world order. It would usher in an era of international relations based on power and polarity, eroding the role of international law and institutions, and undermining the sovereignty and agency of smaller states. This world order would represent a serious threat to US interests, as currently defined. On the other hand, transactional, “thin” ties between China and Russia allow the US some breathing space. Instead of a revisionist authoritarian alliance, the US would confront two states that represent different types of challenges. In this case, Washington could deal with the acute, militarized threat of Russia in the near term, while remaining postured to confront the “pacing” threat of China—the only potential peer competitor to the US—over the longer term.

The academic and policy worlds have been seized with the China-Russia relationship for almost two decades. Policy debates revolve around how to confront the two, with some arguing that the current focus on reversing Russia’s invasion of Ukraine puts the US at risk of being unprepared for the threat China represents. Others argue that Russia is not merely a disruptive power but represents a profound and immediate danger to US interests. Competition for resources often lurks in the background of this debate: US government organizations focused on Europe tend to argue for focusing on Russia first; those with an Indo-Pacific focus tend to argue that China should be the focus. What this debate often fails to consider is the nature of their relationship and its impact on US policy options. The scholarly debate fills this gap by focusing directly on the nature of the relationship: one camp defines it as a strategic partnership and the other defines it as an “axis of convenience.” Often missing from scholarly analysis, though, is an analysis of the implications for US policy. In other words, scholars often argue forcefully for one of these characterizations of the China-Russia relationship but then fail to advise what the US should do in response. Instead, their analysis focuses on the implications of the relationship for theoretical approaches to international relations.

The book that will include this report aims to close this gap between the policy and scholarly debates. It aims to provide a better understanding of the nature of the China-Russia relationship and use that understanding to inform US policy options. It will do this through a novel approach. Instead of focusing on Chinese-Russian interaction at the level of the international system, as most approaches do, it focuses on their interaction “on the ground” in regions where both have important interests at stake. This report examines Chinese-Russian interaction in Africa; other chapters of the book focus on Central Asia, Eastern Europe, and East Asia. Africa and Central Asia provide good testing grounds for the China-Russia relationship because both have important but different interests there. How they advance and defend those interests and how they interact in doing so, can yield important insights into the nature of their overall relationship. These regions are also important because the US footprint is light. The US has been called the “binding agent” in ties between Beijing and Moscow. The idea here is that shared resistance to the US is the only major thing they have in common. In this view, removing the US from the equation will make China and Russia more likely to find reasons to compete rather than cooperate.

President of China Xi Jinping attends the plenary session as Russian President Vladimir Putin delivers his remarks virtually during the 2023 BRICS Summit at the Sandton Convention Centre in Johannesburg, South Africa on August 23, 2023. GIANLUIGI GUERCIA/Pool via REUTERS

Eastern Europe and East Asia provide a different sort of test of the relationship. In each of these regions, one of the two is locked in a geopolitical competition with the US and defines the stakes as existential. In Eastern Europe, Russia and the US (along with its allies and partners) are struggling over the fate of Ukraine and over the future Euro-Atlantic security order more generally. In East Asia, China insists the US cede a territorial sphere of influence and sees US relationships with China’s neighbors South Korea and Japan as unacceptable infringements on this sphere. Beijing also insists that Taiwan is an integral part of China and seems increasingly willing to use coercion—and eventually possibly military force—to get its way.

To analyze Chinese-Russian interaction, this report and forthcoming book use a framework common in US government circles: the Instruments of Power. This framework focuses on how states use their diplomatic, military, and economic power to advance their interests.[1] This report analyzes Chinese and Russian diplomatic, military, and economic activity in Africa, the interests each activity is designed to advance, and how Beijing and Moscow interact in each of these areas. The report characterizes these interactions in four ways: cooperative, complementary, compartmented, and competitive. Cooperative interaction occurs when China and Russia jointly and formally coordinate their activities in pursuit of shared objectives. Complementary interaction takes place when each is aware of the activities of the other and structures its own activities to complement these, or at a minimum not to interfere with them. Compartmented interaction is when each pursues its own goals without those of the other as a factor. Finally, competitive interaction occurs when China and Russia see each other as rivals and work to gain advantage over the other.

Despite the regular statements of personal admiration between Xi Jinping and Vladimir Putin and their description of the partnership between their countries as having “no limits,” a different picture emerges at lower levels of analysis. Many Africans who deal with both countries see an emerging rivalry between them in Africa; many also believe that China is in the superior position and that its advantage will widen with time. But this does not necessarily mean they are destined for conflict, in Africa or elsewhere. After all, the US and its allies and partners compete in many ways, without affecting their overall relationship. As a South African scholar told me, although China and Russia in Africa have, at best, a passive, proxy-type partnership, “at the same time, over the next twenty years they won’t stab each other in the back.”[2]

The View from Africa

In February 2023, six warships—three Chinese, two Russian, and one South African—met in the waters of the Indian Ocean. For the next ten days, these ships conducted an exercise that critics said was “tantamount to endorsing the Kremlin’s onslaught on its neighbor,”[3] since the one-year anniversary of Russia’s invasion of Ukraine fell during the drills. The exercise, named Mosi-2—the first occurred in 2019—was symbolic for another reason: it indicated Africa’s rising importance for Beijing and Moscow. After rising steadily for two decades, Chinese and Russian interest and activities in Africa saw a tremendous increase in 2022 and 2023. Aside from conducting naval exercises, Beijing and Moscow engaged in a flurry of diplomatic activity in Africa. Russian Foreign Minister Sergei Lavrov, who had never visited previously, made four visits in 2022 and the first half of 2023, touching down in 14 countries. Qin Gang, China’s Foreign Minister at the time, visited five African countries in early 2023, and President Xi Jinping visited South Africa for the BRICS Summit in August of that year, extending his visit to conduct meetings with his South African counterpart, Cyril Ramaphosa. In Mali, French and UN peacekeeping missions folded their flags and departed at the request of the Malian government which invited Russian Wagner mercenaries to take their place. As Chinese and Russian presence expanded, observers began to question whether cooperation, competition, or something else would ensue between them.

While there is no clear consensus among African experts on the nature of Chinese-Russian interaction there, few see the two as true strategic partners. Sandile Ndlovu, a defense industry executive in South Africa, remarked that Russia and China are competing although there is no outward animosity.[4] He sees little cooperation or even complementarity in their activities and claims that Russian contacts often ask him for information on Chinese activities in South Africa.[5] Dr. Philani Mthembu made a similar point, observing that when meeting with one, the other often comes up. Chinese and Russian representatives often ask how South Africa is engaging with the other and what South African positions are on the other’s geopolitical interests and challenges.[6] Ndlovu ended on this note, “They don’t like each other, they are here to counter each other.”[7] Many Africans, he said, make a clear distinction between the two, with Russia seen as more self-interested and aggressive about what it wants. Russia is also seen as a risky partner because of its “outward aggression toward the West.”[8]

Dr. Paul Tembe, a South African scholar, opined that the West worries too much about China and Russia in Africa. Tembe sees no coordinated strategy between them and noted that the US fixation with China gives South Africa agency and leverage with Washington that it would otherwise lack. At best, says Tembe, China has a “passive, proxy-type alliance with Russia.” In fact, Tembe says he sees “more cooperation between the US and China, in terms of having a footprint in Africa, rather than [between] Russia and China.” Tembe concluded that, while Beijing and Moscow are not partners in Africa, “at the same time they won’t in the next two decades stab each other in the back.”[9] In Ethiopia, Dr. Woldeamlak Bewket sees a similar dynamic: out of deference to each other, Beijing and Moscow steer clear of the other’s projects and interests there. The result is that there is neither collaboration nor competition between them.[10] These characterizations imply a relationship that is less than a true alliance or partnership. If the two saw each other as true allies, their activities would be cooperative or complementary, not compartmented as Tembe and Woldeamlak describe them.

African experts agree that China and Russia have unequal influence, with the former far more influential. Russia may have “historical pull” due to the Soviet Union’s Cold War support for national liberation movements, but this is rapidly fading. [11] Some experts see China as so far ahead in Africa that Russia risks not being taken seriously.[12] China’s presence is large and broad-based, spanning diplomatic, security, and economic spheres. Russia’s is far narrower, focused on arms sales, providing security to friendly governments, and exploiting the continent’s mineral and energy resources.

Russian frigate Admiral Gorshkov and Chinese frigate Rizhao (598) are seen ahead of scheduled naval exercises with Russian, Chinese and South African navies, in Richards Bay, South Africa, February 22, 2023. REUTERS/Rogan Ward

Diplomatic Presence and Interaction

With embassies in all 54 African countries, China’s diplomatic presence in Africa is significantly stronger than that of Russia, which operates 39 embassies. Even in countries where both have embassies, China’s is often much larger. An American official in Kenya, for example, noted that China has three defense attachés posted there while Russia has none. Russia’s declining diplomatic influence in Africa was visible in the July 2023 Russia-Africa Summit. While 49 of the 54 African countries sent delegations, only 17 heads of state attended, down sharply from the 43 who attended the first such summit in 2019.[13] Putin’s personal stature became an issue at the 2023 BRICS Summit hosted by South Africa: the Russian President chose not to attend due to an arrest warrant issued for him by the International Criminal Court (ICC). As a member of the Court, South Africa would have been legally obligated to enforce the warrant and arrest Putin.

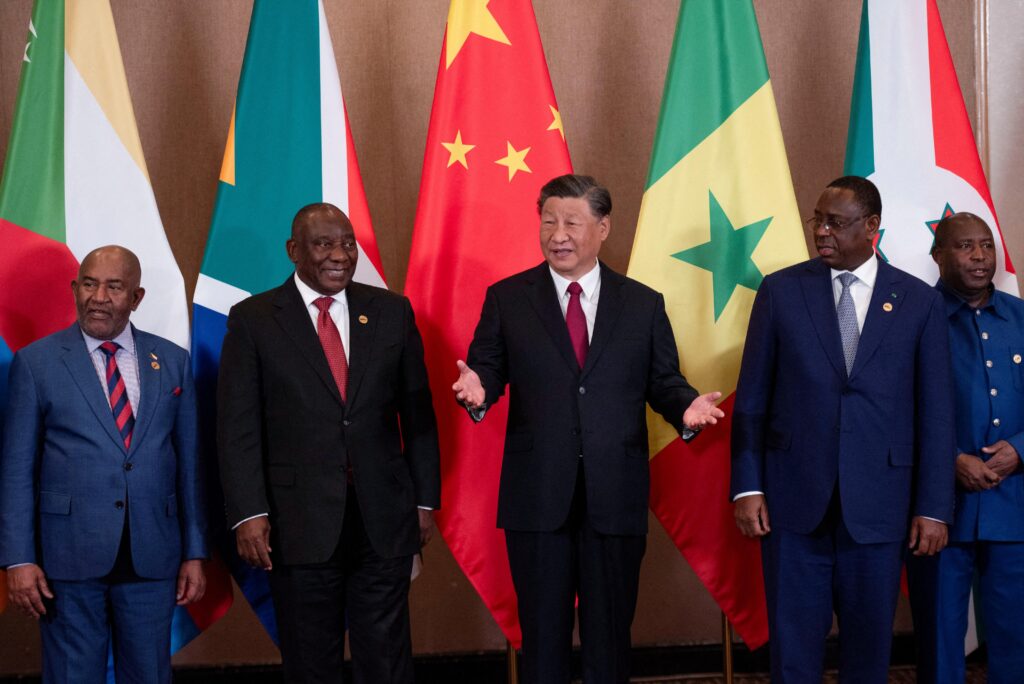

Despite Putin’s absence, Beijing and Moscow were eager to use the BRICS Summit to highlight their partnership and the alignment of their interests in Africa. The two have been the biggest proponents of expanding the bloc, a step about which other members had expressed skepticism. At the summit, China and Russia got their way: the organization announced that it will invite Iran, Saudi Arabia, the United Arab Emirates, Argentina, Egypt, and Ethiopia to join, with the membership effective as of January 1, 2024.[14] BRICS countries already represent 40% of the world’s population and 25% of its GDP, both are now set to increase further. Three of the new members—Iran, Saudi Arabia, and the UAE—are among the world’s top oil producers, and they will now join Russia, currently number three in the world, as BRICS members. But the new members also bring challenges: Argentina and Egypt are the International Monetary Fund’s (IMF) biggest debtors and have required bailouts, and the US and EU have been harshly critical of Ethiopia’s war in its Tigray region.[15] Whether the BRICS can maintain its stated aim as a voice for the Global South after expansion remains to be seen.

China and Russia both see the 2023 BRICS Summit host South Africa as their preferred regional partner and surrogate.[16] There are good reasons for this. South Africa has the third largest economy and the sixth largest population in Africa and a long history of friendly ties with Moscow and Beijing. South Africa’s political elite is still largely made up of the generation that struggled against apartheid. While Western countries equivocated or even supported the apartheid regime, China and the Soviet Union supported the anti-apartheid movement.[17] This support for South Africa’s struggle against apartheid continued the pattern of Soviet and, to a lesser extent, Chinese support for anti-colonial liberation movements elsewhere in Africa. Supporting independence movements and providing aid to governments battling internal or external conflict allowed the Soviet Union to penetrate all the major countries across Africa including, but not limited to, Algeria, Angola, Egypt, Ethiopia, Libya, and Mozambique.[18]

President of China Xi Jinping and South African President Cyril Ramaphosa attend the China-Africa Leaders’ Roundtable Dialogue on the last day of the BRICS Summit, in Johannesburg, South Africa, August 24, 2023. REUTERS/Alet Pretorius/Pool

These Cold War ties can still pay diplomatic dividends. South Africa has been a leader in Africa, and Africa has been a leader in the Global South in undermining Western attempts to isolate Russia diplomatically for its invasion of Ukraine. Shortly after Russia launched its invasion, South African President Ramaphosa called Putin and offered South Africa as a mediator in the conflict. Putin accepted the offer and encouraged Ramaphosa to play his “due mediation role.”[19] Ramaphosa later led a group of seven African leaders to Ukraine and Russia in a mediation bid. Voting records of African countries in the UN also reflect this “no fault” view of the war in Ukraine. In the March 2022 UN General Assembly resolution condemning the Russian invasion, South Africa led a bloc of African countries that abstained. Over 81% of non-African member states voted for the resolution, but just over 51% of African members did, underlining the fact that opinion on the continent is split over fault for the war.[20] When the UN General Assembly voted in October 2022 to condemn Russia’s annexation of four Ukrainian regions, South Africa also led a group of 19 African countries that abstained from the vote. This number of abstentions out of the 54 African countries is notable for a resolution that passed with 143 countries voting yes, only five voting no, and 35 total abstentions.[21] Finally, in the February 2023 resolution calling for Russia to withdraw from Ukraine, which passed with the support of 141 countries, South Africa was among a group of 15 African countries abstaining.

Russia is eager to use its limited diplomatic weight in Africa to ensure this persists, and it has engaged in a flurry of diplomacy to that end. Foreign Minister Lavrov, who had never visited Africa before Russia’s 2022 invasion of Ukraine, made four visits in the first 18 months after the war began. In July 2022, Lavrov visited Egypt, Congo-Brazzaville, Uganda, and Ethiopia, and he met the African Union (AU) leadership in Addis Ababa, Ethiopia. In two visits during the first half of 2023, Lavrov visited South Africa twice and Eswatini (Swaziland), Angola, Eritrea, Mali, Mauritania, Sudan, Kenya, Burundi, and Mozambique.[22] Finally, he represented Putin at the August 2023 BRICS Summit in South Africa, which the Russian President skipped due to the arrest warrant the ICC issued for him.

China’s historical support for the liberation movements in Africa also continues to pay dividends, as does its continued focus on South Africa as a regional leader. After Xi J took office as President of the People’s Republic of China in 2013, his first international trip was to South Africa, and he visited three times in the next five years. As a result, South Africa became the first African country to sign a memorandum of cooperation with China on the Belt and Road Initiative (BRI), and the country currently accounts for 25% of Africa’s trade with China.[23] Almost all African countries followed South Africa’s lead: by 2020 only five—Eritrea, Benin, Mali, São Tomé and Príncipe, and Eswatini—had neither signed an agreement nor expressed support. And even in these countries, China invested in infrastructure projects and pushed for diplomatic ties undeterred and largely successfully.[24] Interestingly, despite the investment of diplomatic energy into South Africa as a regional surrogate by China and Russia, the South African public is skeptical of both. Only 28% of South Africans hold a positive view of Russia while 57% hold a negative view.[25] China fares slightly better with 49% holding a positive view and 40% holding a negative view. Negative views of China have increased by 5% since 2018.[26] It will be important to watch these negative public perceptions for whether they persist and influence Pretoria’s policy.

Despite their different diplomatic weight and divergent priorities in Africa, China and Russia share the goal of undermining Western influence there. They also leverage their status as permanent members of the UN Security Council to mobilize the voting power of African countries, which form the largest regional voting bloc in the UN General Assembly.[27] China’s diplomatic actions in Africa contain a pragmatism and—at least rhetorically—an element of win-win cooperation absent from Russia’s. In the Horn of Africa, for example, Chinese diplomats have publicly called for more intraregional dialogue to address security challenges, for developing the Mombasa–Nairobi railway and the Ethiopia–Djibouti railway while accelerating the development along the coasts of the Red Sea and East Africa, and for working to overcome governance challenges.[28]

While Beijing’s diplomatic efforts sometimes bear awkward names, they focus on tangible results. For example, “Uphold Original Aspirations and Glorious Traditions Set Sail for An Even Brighter Future of China-Africa Cooperation” contains language to promote amity, good faith, shared interests, and building a stronger China-Africa community with a shared future.[29] China also seems comfortable working with governments of all types, while Russia prefers authoritarian regimes. In Djibouti, Chinese analysts note that the stable, open, multiparty political system and liberalized trade policies make it attractive for Chinese investment.[30] Finally, China’s approach is broad-based and multilateral, encompassing the BRI, Global Development Initiative (GDI), and Global Security Initiative (GSI). Together, these extend Beijing’s infrastructure investment, capacity building, and regional security engagement as platforms to propagate China’s model of governance in Africa.[31]

As it is elsewhere, Russia is more of a disruptor than a builder in Africa. It also gives higher priority than China to their shared goal of undermining Western influence. Where China is willing to work with democracies (as the Djibouti example shows), Russia prefers working with authoritarian regimes, especially those where it can use corrupt practices to buy influence. Moscow’s “authoritarian-kleptocratic” model is popular in countries like Sudan, Madagascar, Zimbabwe, Congo-Brazzaville, South Sudan, Eritrea, Uganda, and Burundi where elites benefit financially from Russia’s presence. Mercenaries, election interference, disinformation, and intimidation are common Russian tactics in these countries.[32] The Wagner Group, a notorious Russian private military and security contractor (PMSC) often acts as a Kremlin surrogate in Africa. Wagner helped bring the warlord Khalifa Haftar to power in Libya in 2019; in the Central African Republic (CAR), a Russian assumed the role of National Security Advisor, and Russia played an influential role in President Faustin-Archange Touadéra’s reelection in 2020; and in Mali, Russia spread disinformation and participated in a military coup in August 2020. After the 2023 coup in Niger, the military junta there openly requested assistance from the Wagner Group in maintaining power after calls by Western countries to restore democracy. Russia’s disruption makes sense given its narrow, extractive economic interests, as compared to China’s broader economic interests that need stability to succeed.

The story of Chinese and Russian diplomatic presence and interaction in Africa is complex. The two share the goal of undermining Western influence there, although Russia seems more determined to do this regardless of the disruption it might cause in other areas. Both are also happy to work with authoritarian regimes and to overlook the corruption and human rights abuses that cause Western countries to eschew cooperation with some African governments. However, China is more pragmatic in this regard, willing to work with democratic governments if doing so advances its infrastructure, economic development, and security goals. Beijing and Moscow—especially the latter—have also successfully capitalized on their support for African liberation movements to sustain strong diplomatic relations with many African governments. South Africa has been a focal point for Chinese and Russian diplomatic engagement, which Pretoria has repaid with consistent support for China and Russia in international institutions.

But calling their diplomatic relationship in Africa cooperative is a stretch. In some areas—their support for South Africa’s role is an example here—Beijing and Moscow coordinate their activities. More often, their activities are compartmented: each is aware of what the other is doing and stays out of the way. As several experts noted, each country often asks Africans what the other is up to on the continent, implying they share little information directly with each other. As Tembe noted, at best China has a “passive, proxy-type alliance with Russia.” He then concluded, “I see more cooperation between the US and China, in terms of having a footprint in Africa, rather than [between] Russia and China.”[33] While the US and China are certainly not partners in Africa, Tembe’s point is that the two share similar goals for Africa’s economic development. Russia sees Africa in more instrumental terms, as a region in which to extract resources, burnish its reputation as a provider of security to friendly regimes, and undermine Western influence. The main area of divergence that may emerge between China and Russia in Africa is between Russia’s role as a disruptor of Western influence regardless of the chaos it causes, and China’s focus on infrastructure projects, economic development, and trade links, all of which require stability.

Russian officers from the Wagner Group are seen around Central African president Faustin-Archange Touadera as they are part of the presidential security system during the referendum campaign to change the constitution and remove term limits, in Bangui, Central African Republic July 17, 2023. REUTERS/Leger Kokpakpa

Military Presence and Interaction

In terms of military or security presence in Africa, Russia for the moment occupies the superior position. Part of the reason for this is that Moscow’s military presence serves different ends and uses different means than Beijing’s. China prioritizes its economic goals, and its security activities serve to support those. The goal is to enable security by addressing causes of conflict without having to deploy its military forces. Russia more narrowly focuses on protecting friendly African governments and its own narrow, often extractive, economic interests. To do this, it often uses PMSCs like the Wagner Group rather than conventional military forces. As with their diplomatic presence in Africa, the two share the goal of undermining Western security presence, although this matters more to Russia. Both use military aid, arms sales, exercises and exchanges, and basing to advance their security goals in Africa; Russia also uses direct intervention, almost exclusively by the Wagner Group.

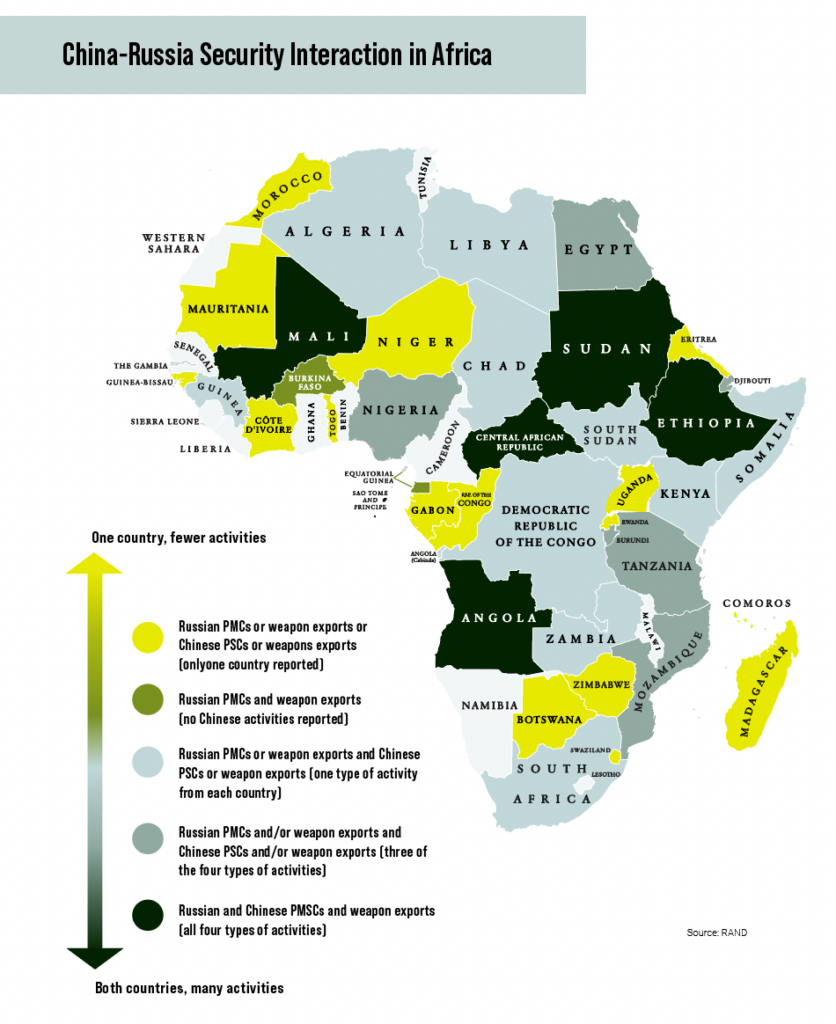

One simple way to understand Chinese and Russian security presence in Africa is to compare the number of countries to which each sends weapons and PMSCs. By this measure Russia’s edge in “boots on the ground” is clear. Russian PMSCs operate in 31 African countries while their Chinese counterparts operate in 15. This is not an exact measure of power and influence, since Russian and Chinese PMSCs are very different entities. The most notorious Russian PMSC is the Wagner Group, which engages in direct combat, has been sanctioned internationally, and has committed war crimes and other atrocities documented by the UN and other organizations. Chinese PMSCs almost always operate unarmed and serve to protect and secure China’s economic interests in Africa, such as mining facilities, ports, and infrastructure projects. China holds a slight edge in the number of countries buying weapons: 17 African countries have purchased Chinese weapons while 14 have purchased Russian weapons.[34] But in terms of the overall value of arms exported to Africa, Russia recently took a slight lead.[35]

The framework for China’s security presence in Africa, as it is in many other places, is the GSI. Unveiled in 2022, the GSI serves two main purposes: offer an alternative model of security to that contained in the US-led world order (which Beijing describes as US “hegemony”), and address causes of insecurity that threaten China’s economic interests. Through the GSI, in which Africa figures prominently, China promotes itself as a “dispute arbiter, architect of new regional security frameworks, and trainer of security professionals and police forces in developing countries.”[36]

Commensurate with its global ambitions and economic investments in Africa, China’s aid and arms sales to African countries have risen significantly over the last several years. Between 2017 and 2022, Beijing offered $100 million in new military aid to AU countries. Between 2017 and 2021, it exported three times as many weapons to sub-Saharan African countries as did the US. Six African countries—Zimbabwe, Mozambique, Namibia, Seychelles, Tanzania, and Zambia—each received more than 90% of their arms from China over this period.[37] Aside from aid and arms sales, Beijing uses military education to advance its interests in Africa. Although hard figures are difficult to obtain, US analysts say thousands of African military personnel attend education and training programs in China annually.[38] One Chinese military college alone boasts ten defense chiefs, eight defense ministers, and several former presidents among its African alumni.[39]

China’s military exercises and exchanges with African countries have also ramped up in the last several years, often with a maritime focus. Geographically, West Africa gets special attention from the Chinese military for good reason. The region accounts for 25% of Africa’s maritime traffic, 67% of its oil production, and faces significant security threats. Piracy is a major concern for both Beijing and regional countries, accounting for the loss of roughly 6% of the oil output of Nigeria, the continent’s largest producer. In a bid to increase security and protect its interests in the region, China has conducted almost 40 exchanges with partners from the Gulf of Guinea and has deployed its navy in anti-piracy operations.[40] On the other side of the continent, the Horn of Africa also gets special emphasis. Beset by piracy like the Gulf of Guinea and jutting into the strategically important Bab al-Mandab Strait, which connects the Red Sea and the Gulf of Aden, the Horn has long been a focus of Chinese naval attention.

Indeed, the Horn of Africa was the site of China’s first overseas military base, which opened in Djibouti in 2017. Officially a “rest and replenishment support facility,” the base allows the Chinese military to carry out missions such as escort, peacekeeping, and humanitarian relief in the Gulf of Aden and the waters off Somalia.[41] Chinese experts note that the base improves support for Chinese anti-piracy operations off the east coast of Africa, to which the Chinese Navy deployed 28 naval task forces between 2008 and 2017. In the past, Chinese ships resupplied primarily in Oman and Yemen, the latter of which has been embroiled in a civil war since 2014. The base in Djibouti, Chinese-run and in a comparatively stable country, eases the problem of logistics for Chinese ships in the region. Of course, the same analysts note that Djibouti is in a strategic location and that France, the US, and Japan all have bases there. They also argue that, with the increasing number of Chinese-funded enterprises in Djibouti, “the protection of China’s overseas interests has become an issue to be considered.”[42] China’s first overseas base is more than a hub to enable Beijing’s humanitarian and anti-piracy operations; it also has geopolitical and geoeconomic value.

China’s next base in Africa will likely be in Equatorial Guinea, on the continent’s Atlantic coast. Despite being blessed with significant oil reserves and boasting the highest GDP per capita in Africa, Equatorial Guinea’s corruption and mismanagement have caused it to accrue debt to China amounting to 49.7% of GDP. China extended an oil-backed credit of $2 billion for the development of Bata Port, which was completed in 2019. US officials have consistently warned that Beijing intends to establish a naval base there, its first such facility on the Atlantic, a move with far-reaching geopolitical implications.[43] The US Department of Defense believes that a base in Equatorial Guinea would not be China’s last in Africa, noting that Beijing has considered 13 countries for military basing access, including Angola, Kenya, Seychelles, and Tanzania.[44]

While its interest in acquiring bases in Africa has increased, China remains reluctant to deploy its military there. One reason for this is Beijing’s noninterference policy, which has been a crucial tenet of its foreign policy since being enshrined in the communiqué of the 1955 Africa-Asia Conference. This policy is important to China for two reasons: it provides a rhetorical shield against criticism of Beijing’s policies and actions toward Taiwan, Xinjiang, and Hong Kong; and it allows China to critique other great powers—especially Western ones—when they intervene in the internal affairs of other countries.[45] To this point, China has protected its interests in Africa by hiring private security firms, deploying its own police forces, and contributing to UN operations. Chinese state-owned enterprises spend more than $10 billion annually, a sizeable chunk of which goes toward paying Chinese security companies to protect its interests in Africa.[46]

China’s law enforcement presence in Africa has expanded exponentially over the past decade. Beijing has developed formal policing agreements with some 40 African countries, sent more than two thousand African police and law enforcement personnel to China for training between 2018 and 2021, and trained over 40,000 African lawyers since 2000.[47] Aside from protecting China’s economic interests in Africa, its police presence and extradition agreements allow the Chinese government to monitor and—when it deems it necessary—punish the behavior of its citizens abroad. Almost all Chinese military presence in Africa exists as contributions to UN operations there. Over 80% of all Chinese peacekeepers are deployed to Africa, and over 32,000 Chinese soldiers have served in UN missions there, the highest number among permanent members of the UN Security Council.[48] Like many other countries, China uses its UN peacekeeping deployments to support its own foreign policy goals under cover of the UN flag. In Africa, these include “a legal and normalized means to protect its massive investments, obtain needed hard and soft military skills, and enhance its reputation as a benevolent rising superpower actively engaged in the UN system.”[49]

As China’s interests in Africa continue to expand, it is unlikely it will be able to protect them with the current model of private security, Chinese police, and UN peacekeeping presence. A Chinese worker was wounded in an attack by the militant group al-Shabaab in 2022, and nine Chinese workers were killed in a militant attack on a gold mine in the CAR in March 2023.[50] In July of the same year—in a rare instance of direct Russian-Chinese interaction in Africa—Wagner Group mercenaries rescued a group of Chinese miners when militants attacked the same gold mine again.[51] Incidents like these will provide a powerful incentive for Beijing to deploy more and better-armed security to protect its African interests, which could cause it to qualify or de facto abandon its noninterference doctrine.

Russia has no such doctrine, freeing it to advance its interests in Africa in any way it sees fit. Like China, it uses a combination of military tools including military aid, arms sales, exercises and exchanges, and basing to do so. Unlike China, Russia has been willing to intervene directly in Africa, usually through the Wagner Group. Where Chinese PMSCs limit their activities to providing security for China’s economic interests in Africa, Wagner’s involvement has been much broader and deeper. Another difference between China and Russia is in the provision of military aid. China provides direct financial aid to African countries and organizations—such as the $100 million in aid it pledged to the AU. Russia’s approach is more mercenary: while happy to provide weapons, it expects payment, and African countries seem happy to oblige. In the context of overall declining arms imports by African countries between 2018 and 2022, Russia overtook China as the leading arms exporter to sub-Saharan Africa, with its market share rising from 21% to 26%, while China’s fell from 29% to 18%. In overall arms sales to the continent, Russia’s share is even larger at 40% due to its substantial, long-standing clients Egypt, Algeria, and Sudan.[52] The inferior performance of Russian arms in Ukraine may diminish Russia’s arms sales to Africa. Although Western countries would seem to benefit from this due to the superior quality of their equipment, that is uncertain because these countries apply human rights or other conditions to the provision of military equipment. Since this is unpalatable to some African governments—including some of the biggest arms importers—China might be among the chief beneficiaries of a drop in African demand for Russian arms.

South African soldiers march during the Armed Forces Day parade ahead of scheduled naval exercises with Russian and Chinese navies in Richards Bay, South Africa, February 21, 2023. REUTERS/Rogan Ward

Russia’s military education and exchange programs for African militaries are more modest than China’s: about 500 Africans study in Russian military institutions annually, compared to the thousands who study in China.[53] Its formal military exercise and training programs are almost nonexistent. Moscow also has no permanent bases in Africa, though it has long sought to build a naval base in Sudan. After years of delay caused by political instability in Sudan, the Sudanese military finally approved the base deal in early 2023.[54] However, the civil war that broke out soon after seems likely to delay the base or cancel it altogether. CAR has also expressed a willingness to host a Russian facility, although no firm plans or agreements exist yet.

Traditional indicators of military presence miss most of the Russian direct military involvement in Africa, which comes in the form of the Wagner Group. Wagner trains African military forces, protects Russian economic interests, provides a conduit for Russian arms sales, scouts sites for Russian military facilities, and engages in direct combat both on behalf of and against African governments. The common denominator in all these activities is the advancement of Russian geopolitical and geoeconomic goals, usually defined as undermining those of Moscow’s Western adversaries. While the largest and best known of Russian PMSCs in Africa, Wagner is not alone there: an analysis by the Center for Strategic and International Studies concluded that there are “at least seven Russian PMSCs that have carried out at a minimum 34 operations in 16 African countries since 2005.”[55]

Wagner has deployed forces to Libya, Madagascar, Mozambique, CAR, Sudan, and Mali at a minimum. Its total number of fighters in Africa may number around five thousand, with half of these in CAR.[56] It employs a three-pronged approach to insinuate itself into African countries, expanding the Kremlin’s influence there. First, it conducts disinformation and information warfare, including fake polls and counter-demonstration techniques. Next, it gains concessions in extractive industries. Especially attractive here is the mining of precious metals. Finally, it establishes a relationship with the country’s military by conducting training, advising, personal security, and counter-insurgency operations.[57] At least part of Wagner’s appeal in Africa is the assumption that it is acting on behalf of the Russian government and provides African governments access to the Kremlin.

A brief survey of Wagner’s activities in Africa illustrates its utility to the Kremlin. In Sudan, where Russia has long-standing ties, Wagner’s involvement enhanced this relationship. Although originally deployed to guard Sudanese gold mines, Wagner kick-started the development of Russia’s naval facilities at Port Sudan. In CAR, up to 670 Wagner “advisors” arrived in 2018 and the group’s footprint has expanded since then. Wagner fighters train government forces and pro-government militias and provide personal security for government officials, including President Touadéra. In Mali, Wagner acted as the advance guard of a nascent but expanding military relationship with Russia and a break with the international community. In 2020, the transitional government of Mali agreed to accept one thousand Wagner Group contractors “to conduct training, close protection, and counterterrorism operations.” In 2021, Russia delivered four attack helicopters to Mali as part of a Mali-Russia military cooperation agreement.[58] In 2022, France and its European allies announced they were ending their counterterrorism mission in Mali after nearly ten years, citing “multiple obstructions“ by the Malian government.[59] Finally, in June 2023, the Malian government demanded the UN withdraw its 13,000 peacekeepers, leaving Wagner as the only foreign force in the country.

For Russia, arms sales and the activities of the Wagner Group compose the bulk of its military presence in Africa. The latter often enables the former: where Wagner goes, arms sales often follow, as the example of Mali shows. As it has in Sudan, Wagner often allows Russia to use military facilities without an overt, official presence. This ability to test new environments for military cooperation without overt Kremlin involvement is one of Wagner’s key advantages to the Russian government.[60] Whether that advantage outweighs the clear danger to the Russian state Wagner represents—as evidenced by the June 2023 insurrection—is unclear. Also unclear is the effect of Wagner leader Yevgeny Prigozhin’s death on Wagner operations in Africa. What is clear is that, in Africa, Russia benefits from its informal military presence, and the Kremlin will seek to preserve those advantages through a reformed, post-Prigozhin Wagner Group or other PMSCs.

Chinese and Russian military presence in Africa differ from one another and there is little interaction between the two militaries there. China’s presence is overt, institutionalized, and uses traditional tools of statecraft. Its formal framework in Africa is through the GSI. Beijing is intent on increasing arms sales, military aid, exercises, and basing in Africa. Its conventional military footprint is light outside of the forces it has assigned to UN missions, forces that also serve China’s foreign policy goals. Chinese PMSCs and police forces are the center of gravity of Beijing’s African security presence, which serves primarily to defend and advance its economic interests. Consistent with its economic goals, China maintains geographic focus on the Gulf of Guinea and the Horn of Africa. The former is the epicenter of Africa’s oil trade, and both have been beset by piracy. As China’s economic interests in Africa expand, pressure will build to defend them through more traditional military means. This has two implications. First, the PMSC and police model may prove inadequate. If it does, Beijing may have to consider deploying conventional military forces to Africa or creating a more robust, Wagner-style PMSC to defend its interests. Second, it may feel pressure to—at least de facto—abandon its noninterference policy and intervene overtly in the internal affairs of African countries where it has important economic interests.

Demonstrators hold photographs of Russian President Vladimir Putin and Russian flags during a sit-in to protest against the visit of the French President Emmanuel Macron and France’s perceived support for neighbouring Rwanda, which Congo accuses of supporting M23 rebels in the east, in front of the French embassy in Kinshasa, Democratic Republic of Congo, March 1, 2023. REUTERS/Justin Makangara

Russia’s military presence in Africa is largely unconventional and unacknowledged, but its effects are more significant than China’s—at least for now. Aside from arms sales, long a Russian strong suit, its use of traditional tools of military statecraft lags in comparison to China’s. Its deployment of some five thousand Wagner Group forces to at least a half dozen African countries (and probably twice that number in reality) gives Russia a strong security presence on the continent. Wagner’s approach, which combines information warfare, gaining economic concessions in extractive industries, and building a relationship with African military forces, has given Moscow influence far beyond what traditional indicators would suggest. Russia’s area of geographic focus is the Sahel, where a terrorist threat combined with weak and often corrupt governance provide fertile soil for the Kremlin, through Wagner, to plant roots. After Prigozhin’s death, Wagner’s future is unclear. The Kremlin might break it up, absorb it into the formal military, or leave it intact and install a loyalist to run it. All three options have drawbacks. Breaking it up into smaller PMSCs reduces the economies of scale and unity of command that Wagner had under Prigozhin, which would in turn reduce the overall effectiveness of Russia’s Africa operations. Bringing it under the control of formal military reduces the Kremin’s ability to deny responsibility for its actions, including war crimes almost everywhere it operates. Installing a new, loyalist leader has the fewest drawbacks in the short term. Over the long term, the rivalry that emerged between Prigozhin—a longtime Putin friend—and the formal power structures is likely to reemerge. There is no easy answer to the Wagner question, but given the group’s indispensable role in Africa, the Kremlin will spare no effort to find one.

As in the diplomatic realm, there is significant interaction between China and Russia in their support of South Africa militarily. Both countries have sought to bolster their military ties with Pretoria, and each seems comfortable with the role of the other. In February 2023, the Chinese, Russian, and South African navies conducted the naval exercise Mosi-2 off the coast of South Africa. This followed the first such exercise, held in late 2019. The first anniversary of Russia’s invasion of Ukraine occurred during the 2023 exercise, making the participation of China and South Africa somewhat of a propaganda coup for Russia. For China, the exercise allowed it to highlight the expanding reach of its navy. Both Beijing and Moscow had self-interested reasons for participating in the exercise, but it nevertheless represented a major instance of military cooperation between them in Africa.

Aside from South Africa, there are five countries where China and Russia have noteworthy military or security interaction. Angola, CAR, Ethiopia, Mali, and Sudan have received weapons from both China and Russia, and Chinese and Russian PMSCs have been active in all.[61] The weapons sales make sense since all these countries are or recently have been battling insurgent or terrorist threats. PMSC deployments tell a different story: Angola ($48 billion from 2000–2020) and Ethiopia ($13.7 billion) are the top two recipients of Chinese loans in Africa, so Chinese PMSCs there are probably guarding projects funded by these loans. In Mali, CAR, and Angola, the Russian Wagner Group is present implementing its model of spreading disinformation, gaining economic concessions, and co-opting the country’s security forces. In general, Chinese-Russian military relations in Africa are best described as compartmented. Each is aware of what the other’s activities and interests are on the continent and generally steers clear of these. In the military realm, there is a geographic element to the compartmented nature of their relations: China focuses on the economically important but unstable regions of the Gulf of Guinea and the Horn of Africa, while Russia thrives in—and contributes to—instability in the Sahel region.

Economic Presence and Interaction

The economic instrument of statecraft is where China most overshadows Russia in Africa. Chinese economic engagement has an institutional framework composed of the BRI and the GDI while Russia’s is more ad hoc. China’s loans, aid, trade, and direct investment in Africa dwarf those of Russia. Part of the reason is the huge difference in the size of their economies: Russia’s 2022 GDP of $1.8 trillion makes it a minor economic player when compared to China, with a 2022 GDP of $18 trillion. While China’s growth is slowing, Russia’s fell by over 2% between 2021 and 2022 and looks set to continue to decline as Western sanctions bite.[62] Another reason for their different economic weight on the continent is that Africa simply matters more to China economically than it does to Russia. While both Beijing and Moscow see their engagement with Africa as a means to an end, China’s ends are largely geoeconomic while Russia’s are geostrategic.

The BRI and GDI comprise the institutional framework of China’s government-to-government economic engagement with Africa. The two operate on parallel tracks with the BRI focused on enabling economic growth, primarily through the building of physical infrastructure and the GDI focused on development. As one analysis puts it, “the BRI delivers hardware and economic corridors, while the GDI focuses on software, livelihoods, knowledge transfer, and capacity building.”[63] The former is more established and better known, having been launched in 2013, nine years before the latter. A total of 46 African countries have signed on to the BRI, representing 94% of sub-Saharan Africa and 85% of the Middle East and North Africa region.[64] These countries also contain over one billion people and cover about 20% of the world’s land mass.[65] Largely because of the BRI, Africa has become China’s second largest market for overseas contracts; Chinese firms have built or upgraded over 10,000 kilometers of railway and over 100,000 kilometers of highway in Africa.[66]

The benefits that accrue to China through the BRI are not only economic ones. It provides jobs for Chinese firms and workers and builds infrastructure that enables the delivery of Chinese goods to foreign markets but also provides diplomatic benefits to Beijing. For example, in part due to China’s economic assistance, Ethiopia has supported China’s Taiwan anti-secession law, and, as a member of the UN Human Rights Council, it helped defeat resolutions critical of China.[67] China also uses BRI projects in a more coercive manner. When Kenya banned Chinese fish imports to protect its local fishing industry in 2018, China threatened to halt funding for a major BRI railroad project in the country, causing the Kenyan government to quickly reverse its decision.[68]

Despite the leverage its loans give China over African governments, the BRI maintains popularity as indicated by both anecdotal and statistical evidence. A 2022 survey by a Kenyan think tank showed that China fares better than the EU when it comes to meeting what respondents consider their priority needs, such as building useful infrastructure, doing it quickly, and not interfering in the internal affairs of African countries.[69] Another Kenyan think tank published a report claiming that the BRI had expanded the ”development space” in the country, helped the government achieve its 2023 Vision Plan, and slowed the rise of Kenya’s debt through innovative investment and cooperation models.[70] Kenyan scholars describe the China-Africa relationship as symbiotic. China needs raw materials for manufacturing, while Africa has raw materials but lacks the infrastructure to get them to market, so “China extracts natural resources and provides the much- and urgently-needed financial support for infrastructural development.”[71] An Ethiopian scholar noted that Chinese BRI projects are “observable things, including in the most remote regions of the country,” and that many Ethiopians see China as a “problem solver for their most immediate problems.”[72] Another remarked that, unlike the West which invests a lot in capacity building, China invests in “physical projects” and finishes them quickly, both of which people like.[73] Another, less positive reason for the BRI’s popularity among African governments is China’s “no strings” approach, which allows recipients to avoid accepting the labor and environmental standards Western lenders and international financial institutions require.[74]

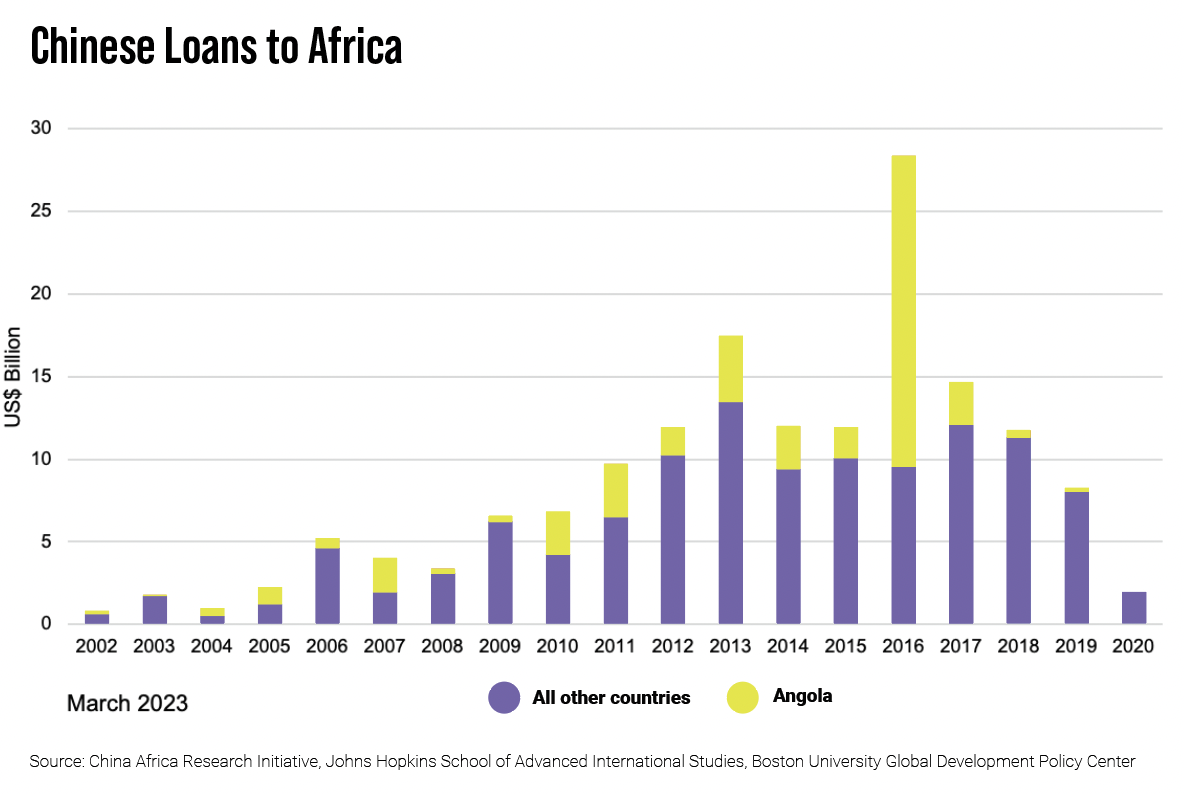

Through the BRI, China has become the largest bilateral lender to Africa.[75] Between 2000 and 2020, China loaned just under $160 billion to African countries: Angola ($42.6 billion), Ethiopia ($13.7 Billion), Zambia ($9.8 billion), and Kenya ($9.2 billion) were the top recipients of loans.[76] The focus areas for BRI loans have been railroads, roads, ports, oil and gas fields, and power plants. After twenty years of lending by China, there is mounting concern about the ability of African countries to pay their debts. As of November 2022, the IMF and World Bank listed 22 African countries as either in debt distress or at high risk of it.[77] Zambia, one of the top recipients of Chinese loans, is in the worst shape. In 2020, it defaulted on its external debt of $17.3 billion of which China owns $5.8 billion. Chinese lenders, unlike international financial institutions, have little experience in dealing with default from debtors as China has only been a major international lender for two decades. While the People’s Bank of China showed a willingness to restructure Zambia’s loans, the Ministry of Finance expressed reservations. The concern in the Finance Ministry is that if the Chinese side bears huge losses in Zambia, this would “set an expensive precedent” by signaling to other countries that defaulting to China is an option.[78] Chinese analysts have also expressed concern about Djibouti, a key diplomatic partner and the site of China’s first overseas military base. The country’s small GDP, low fiscal revenue, limited foreign exchange reserves, and high debt-to-GDP ratio call into question its ability to repay the $1.5 billion in Chinese loans it accepted.[79]

China has responded to the increasing debt distress among African countries by scaling back its lending to the continent. Between 2019 and 2020, Chinese loan commitments to Africa dropped by 30%.[80] At the December 2021 Forum for China-Africa Cooperation (FOCAC) China pledged $40 billion in loans to Africa for 2022, down 33% from each of the previous two years.[81] As Africa’s debt distress has mounted, the BRI has been the subject of considerable criticism, especially from Western governments. In this “debt trap diplomacy” narrative, Beijing’s opaque lending practices, predatory loan terms, and draconian response to the cash flow problems of its debtors make it a dangerous creditor to do business with. Worse still, when debtors are unable to make their payments, China is said to swoop in and seize the infrastructure it built. Despite the power of this narrative and its widespread acceptance in many Western countries, the truth is more complicated.

In a 2019 examination of Chinese lending practices, Dr. Patrick Maluki and Dr. Nyongesa Lemmy define debt trap diplomacy as one country excessively lending to another with the expectation of gaining economic or political concessions when the borrower defaults. Hambantota Port in Sri Lanka is an early example: when the Sri Lankan government defaulted on the loan in 2017, it signed the port over to China for a 99-year lease.[82] In Africa, many expected a similar fate for Uganda. In late 2021, a flurry of media reports warned that Uganda was on the brink of defaulting on a loan to expand its only international airport at Entebbe, with some even claiming China had already taken control of it. In truth, loan payments only began in April 2022, and although COVID hit Uganda’s tourist-dependent economy hard, it is currently not at risk of defaulting. The loan terms—a 20-year payment schedule with 2% interest—are so generous as to be classified as “concessional” in the development finance world. But there are also less generous parts of the loan agreement. First, it requires Uganda to deposit all revenue from its Civil Aviation Authority into an account with China’s EXIM Bank and requires funds in that account to go toward loan repayment before any other debts or needs. Next, in case of dispute or default, the loan agreement requires arbitration hearings to be held in Beijing, and the arbitration decision is final and binding, with no appeal possible. Agreements like these, with concessional terms but tough enforcement measures, are typical of Chinese government loans in Africa.[83]

In 2019, Ethiopia—one of the top African debtors to China with some $13.7 billion in loans—appealed to Beijing for a restructuring of its debt. In response, China extended the payment terms from ten years to thirty years. In 2023, China announced a partial cancellation of Ethiopia’s debt, although it provided no details.[84] Many analysts believe China sees debt restructuring as preferable to asset seizures and believe more African countries could be in line for deals like the one Ethiopia secured. They believe Beijing will extend payment terms and adjust interest rates on other loans, essentially “kicking the can down the road” until its debtors find the means to settle their debts.[85] There is a good reason for this. First, it preserves Beijing’s leverage over the policy choices of its debtors, as the examples of Ethiopia’s diplomatic support and Kenya’s reversal of its fish import ban show. Next, it preserves China’s reputation and the image of the BRI among the African public, both of which are positive. In the conclusion of their examination of Chinese lending in Africa, Maluki and Lemmy conclude that China is using the same approach that the IMF and the World Bank used from the 1980s through the mid-2000s and that the debt trap narrative is largely a “creation of competitors, to counter the growing influence of China around the globe.”[86]

China is a major aid donor to Africa, but its aid differs from the type Western countries and international organizations provide. Chinese foreign aid expenditures increased steadily from 2003–2015 and dropped sharply in 2016, but they have since recovered. By 2021, Chinese aid stood at $3.18 billion, the highest in its history. Between 2013 and 2018, almost 45% of all Chinese aid went to Africa.[87] China is the largest overall provider of aid but trails the US, UK, Japan, Germany, and France in traditional aid, often termed Overseas Development Assistance (ODA). ODA consists of grants and highly concessional loans (with a grant element of at least 25%), the intent of which is to improve welfare and economic development. For comparison, between 2000 and 2017, 73% of US aid consisted of ODA while only 12% of Chinese aid did. Instead, some 81% of Beijing’s aid consisted of what is termed Other Official Flows (OOF). These are semi-concessional (grant element of less than 25%) and non-concessional (i.e., market rate) loans and export credits, which do not necessarily have a development intent.

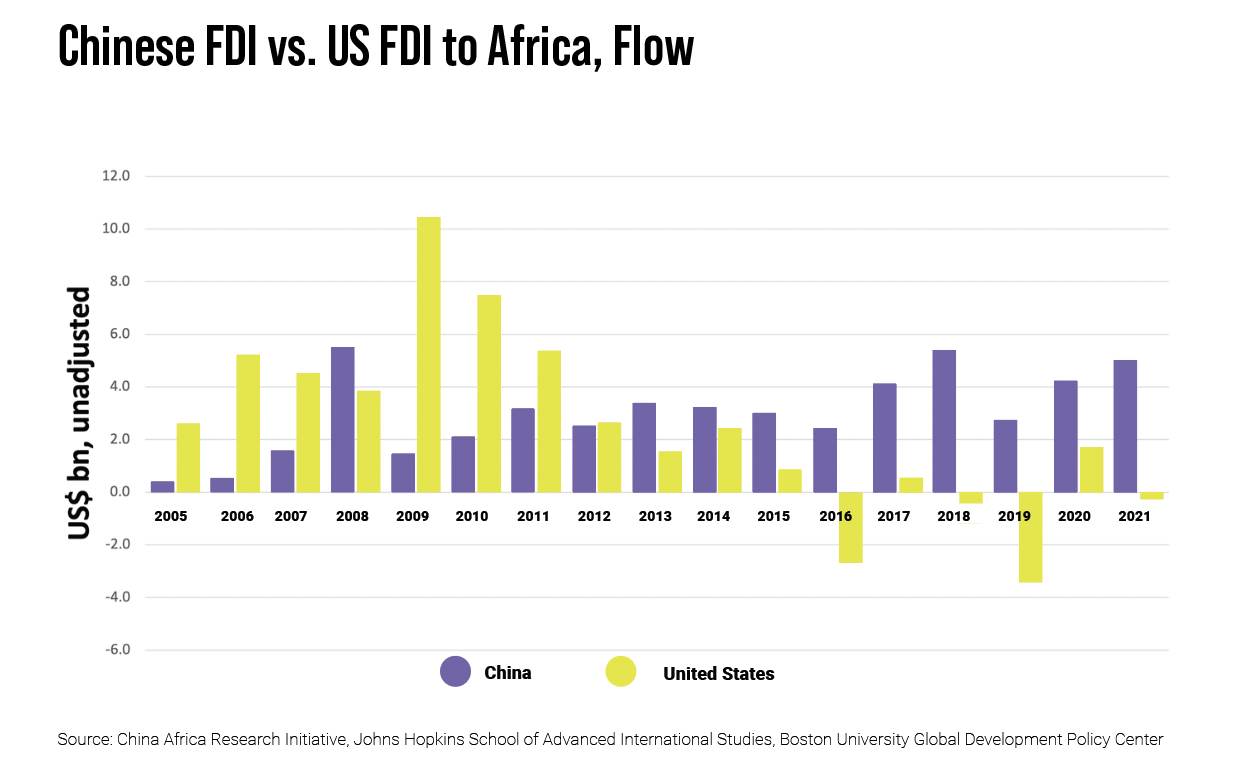

China’s trade with Africa—as with the rest of the world—has risen exponentially over the last several decades. Total trade turnover (exports and imports) stood at just $1.75 billion in 1992; by 2021 it had reached $251 billion. South Africa, Angola, and the Democratic Republic of the Congo were the largest exporters to China; Nigeria, South Africa, and Egypt were the largest importers of Chinese goods.[88] China surpassed the US in 2009 to become Africa’s largest bilateral trading partner, and, by 2021, Chinese trade with Africa was four times that of the US.[89] China’s trade with Africa is fifteen times that of Russia.[90] Still, trade with Africa represents only 6.35% of China’s total trade, making the continent a fairly minor player in the overall Chinese economy.[91]

Chinese foreign direct investment (FDI) in Africa has been increasing steadily since 2003, rising from $75 million to some $5 billion in 2021.[92] China surpassed the US in 2013 to become the largest source of FDI in Africa, and, by 2018, 16% of all investment in Africa came from China.[93] DRC, Zambia, Guinea, South Africa, and Kenya were the leading destinations for Chinese FDI.[94]

In all areas of economic presence in Africa—loans, aid, trade, and FDI—Russia barely registers when compared to China. Part of the reason for this is the recent economic history of the two countries. China’s economic engagement with Africa accelerated in the decade after the collapse of the Soviet Union when Russia’s collapsed along with the rest of its economy. In a surprisingly frank explanation of the situation, a Russian member of the Committee for Economic Policy in the Federation Council, the upper chamber of Russia’s parliament, said, “It is not easy, because 30 years after we left the region, we need to enter a competitive environment… and the conditions that are opening up for Russian business today – they are not quite the same as those for businessmen from France, the European Union, India, or China.”[95] Another reason Russia cannot compete with China’s economic influence in Africa is the size of their economies: Russia’s $1.8 trillion GDP is a far cry from China’s GDP of some $18 trillion. Although China’s economic growth has slowed, Russia’s is projected to contract by 5.5% through 2023 and not recover its prewar value until 2030. This follows a 5.1% drop in Russian GDP per capita between 2010 and 2020.[96]

Russian loans and development aid to Africa are not significant components of Moscow’s economic engagement there. Unlike China’s BRI and GDI, which provide an institutional framework for Chinese aid and are geared toward broad-based development, Russia’s aid to Africa tends to be more ad hoc and overtly instrumental. While it provides little new assistance to Africa, Russia has cancelled some previous loans in a bid to bolster its image as a partner. At the second Russia-Africa Summit in 2023, Russian President Putin announced that Russia had written off debts of African states worth $23 billion. Putin also claimed that 90% of the debts of African countries were settled, with no more “direct” debts but some financial obligations remaining.[97] Since Putin announced the cancellation of some $19 billion in African debt at the first Russia-Africa Summit in 2019, this appears to be an incremental increase of some $4 billion in debt relief. Putin promised free grain to six African countries at the 2023 summit.[98] This is less an indication of Moscow’s largesse than an attempt to repair the damage to its reputation as a reliable supplier. Shortly before the summit, Putin announced Russia would end its participation in the deal that allowed Ukrainian grain to be exported via the Black Sea, drastically reducing grain supplies to highly import-dependent African countries.

As noted, Russia’s trade turnover with Africa is only about one-fifteenth the size of China’s, standing at under $18 billion in 2021.[99] Russia’s modest trade with Africa is unbalanced in terms of exports/imports and its geographic focus. Russian exports to Africa are primarily grains, arms, extractives, and nuclear power, and are seven times the level of Russian imports from Africa, which consist largely of fresh produce. Some 70% of all Russian trade with Africa is concentrated in just four countries—Egypt, Algeria, Morocco, and South Africa.[100] Despite the low level of trade between Russia and Africa, trade dependence is a problem for Russia’s African partners. Africa depends on Russia for 30% of its grain supplies. Nearly all of this (95%) is wheat, 80% of which goes to North Africa (Algeria, Egypt, Libya, Morocco, and Tunisia); other large importers include Nigeria, Ethiopia, Sudan, and South Africa. The disruption to food supply for these countries caused by Russia’s exit from the grain export deal may induce them to diversify their sources of supply.[101]

Russia’s overall FDI in Africa is small, comprising less than 1% of all money invested there, and focused on a few, high-profile projects.[102] The largest of these is the El Dabaa nuclear power plant in Egypt, financed in part through a Russian loan of $25 billion, and scheduled to be completed in 2026. Rosatom, the state-owned Russian nuclear firm, has signed nuclear cooperation agreements with 17 other African countries including Ethiopia, Nigeria, Rwanda, and Zambia. Analysts note that the massive costs of nuclear power plants make them unviable for most African governments but create “ample opportunities for graft, generating political incentives for well-placed Kremlin and African government officials.”[103]

After four years’ construction, the Addis Ababa–Djibouti railway, the longest electric railway in Africa, crossing Ethiopia and Djibouti, was officially opened on October 5, 2016. Africa’s first cross-border electric railway was built by Chinese enterprises and the opening of the railway marks a significant milestone in the development of the two countries. REUTERS

Russian companies are players in Africa’s oil and gas industry. They are significant investors in Algeria’s oil and gas industries and have smaller but still significant investments in Libya, Nigeria, Ghana, Côte d’Ivoire, and Egypt. While Russia has hyped its interests in expanded oil and gas investments, most of these have failed to materialize, leading some African analysts to argue that “Russia’s real aim is to prevent African oil and gas from reaching the global market—and cutting into Russia’s market share.”[104] African analysts also note failed projects in other areas, including Rosatom in South Africa, Norilsk Nickel in Botswana, the Ajaokuta Steel Plant in Nigeria, mining projects in Uganda and Zimbabwe, and Lukoil in Cameroon, Nigeria, and Sierra Leone. These failures have undermined the incentive for bilateral cooperation with Russia, leading it to be “invisible” in the provision of infrastructure for Africa.[105]

Chinese and Russian economic presence in Africa differs in its scale and its objectives. China’s presence and activities benefit from an institutional framework composed of the BRI and the GDI, which impart a strategy to its approach. Beijing’s goals are largely geoeconomic and revolve around developing the trade links that benefit its export-oriented economy. China is the largest bilateral lender, aid donor, trade partner, and foreign investor in Africa. Beijing’s detractors have accused it of engaging in “debt trap diplomacy” by extending predatory loans to African countries and seizing assets when they are unable to meet the terms of the loans. Chinese loans tend to have concessional terms but tough enforcement measures. These measures have not included the seizure of assets. Instead, China has responded to debt distress by renegotiating the terms of individual loans and scaling back its overall lending to Africa.

By comparison with China, Russia is a negligible economic force in Africa, and its approach is more ad hoc and overtly instrumental. Although it has not been a major lender to Africa since the Cold War, Moscow has forgiven billions in African debt to bolster its reputation and economic position on the continent. Russian trade with Africa is comparatively meager and unbalanced, focused on a few commodities and a few countries, and with Russia exporting far more than it imports. Russia’s FDI in Africa is tiny and dominated by a few large projects. Both Beijing and Moscow enable corruption through their economic activities in Africa—China through its “no strings” approach and Russia through investments with built-in opportunities for graft.

In terms of the geographic focus of Chinese and Russian economic activities in Africa, South Africa is the only significant point of convergence. The country was the first in Africa to sign on the BRI, is China’s largest overall African trade partner, and is a major destination for Chinese FDI. It is Russia’s fifth-largest African trading partner. Outside of South Africa, there is little economic overlap between China and Russia in Africa. While Beijing’s focus is on sub-Saharan Africa, especially Angola, DRC, Ethiopia, Kenya, and Zambia, Moscow’s is in North Africa, especially Egypt.

Conclusion

A survey of Chinese and Russian activity and interaction in Africa yields no simple answer to the nature of their relationship there. However, a survey of their activity yields a picture of two very unequal powers. Diplomatically and economically, China dwarfs Russia in Africa. Militarily Russia still retains a significant, if unconventional and unacknowledged, presence.

Diplomatically, China and Russia both leverage their lack of a colonial past in Africa and their support for African liberation movements to ensure support for their positions in UN votes from the 54 African countries, which form the largest geographic voting bloc there. Both look to South Africa as a leader in representing their interests in Africa and in the UN. Beijing and Moscow pushed for, and got, expansion of the BRICS to harness the power of the Global South under their combined leadership. While a larger BRICS will enhance its reputation in this regard, a larger and more diverse set of members will degrade the agility and responsiveness of the organization. China and Russia differ most in the ends of their diplomatic engagement in Africa and the ways they pursue those ends. While they share the goal of undermining Western influence, for Russia this goal overrides all others. As the activities of the Wagner Group demonstrate, Moscow is willing to disrupt and degrade security in Africa if in the process this also degrades Western influence there. China’s diplomatic engagement is broadly based, institutionalized, and has positive goals Russia’s engagement lacks. Where China seeks to promote its model of governance, Russia seeks to undermine that of Western countries.

Militarily, Russia’s presence in Africa is larger than China’s, but it is unconventional and largely unacknowledged. Russia’s engagement in the security sector is also more direct and “kinetic.” The Wagner Group protects the leadership of friendly governments, trains their military forces, and also fights on their behalf. Although it has agreements that allow it to use military facilities in several African countries, Moscow has yet to establish a permanent base on the continent. Chinese presence takes the form of PMSCs that protect Chinese investments, conventional Chinese military forces in Djibouti (and possibly Equatorial Guinea in the future), and a significant presence in UN peacekeeping operations. The latter is an area where Chinese and Russian interests might diverge. China is a major contributor to UN operations in Africa where China deploys approximately 80% of its peacekeepers. Russia, through the Wagner Group, is busy undermining the operations of UN peacekeepers, as the case of Mali makes clear. In terms of direct military interaction between China and Russia, Angola, CAR, Ethiopia, Mali, and Sudan bear watching. All these countries import weapons from both China and Russia and have PMSC presence from both within their borders. If competition ensues, it will likely be in or over these countries.

Economically, there is no comparison between China and Russia in Africa. Like its diplomatic and military presence, China’s economic presence in Africa is broadly based and institutionalized through the BRI and the GDI. The skepticism of China’s economic activity that exists elsewhere, especially Central Asia, is absent in Africa, where the BRI is still seen in positive terms. The debt trap narrative promulgated by many of China’s competitors finds little purchase in Africa, and for good reason. Chinese loan terms there are often so generous as to qualify as concessionary, and China has responded to debt distress where it occurs in Africa by lowering interest rates or extending payment periods. The opacity of China’s lending and its lax adherence to fair labor and responsible environmental standards in Africa leave room for criticism, although little has emerged. In comparison to China, Russian economic presence barely registers in Africa. Trade between Russia and African countries is small and unbalanced, with imports from Russia seven times larger than exports to Russia. It is also geographically concentrated and focused on narrow economic sectors: Egypt, Algeria, Morocco, and South Africa account for the bulk of Africa-Russia trade, and exchange is largely in the oil, gas, and nuclear sectors. Interestingly, Russia acknowledges not only that China is an economic competitor in Africa, but that Russia is ill-equipped to compete due to its economic withdrawal from Africa in the 1990s.

Like that of most countries that are neither treaty allies nor at war with each other, Chinese-Russian interaction in Africa is a mixture of cooperative, complementary, compartmented, and competitive behavior. Their major area of cooperation in Africa is minimizing and undermining Western influence. They do this in several ways. They use their status as permanent members of the UN Security Council to mobilize the voting power of African countries. They also offer “no strings” aid and investment as an alternative to that from Western countries, which comes with requirements designed to promote accountability and transparency. Diplomatically, militarily, and—to a lesser extent—economically, Beijing and Moscow also cooperate in cultivating South Africa as a leader among African countries and a representative of their interests. This is not to deny South African agency—Pretoria has its own interests and pursues those, sometimes using Chinese and Russian support to do so. Interestingly, several South African analysts see little overt cooperation between the two, with one remarking, “They don’t like each other, they are here to counter each other.”[106] While their partnership may lack amity, it is strategic: each understands the importance of the other for its goal of eroding Western influence in Africa, and this enables cooperation. As another South African analyst concluded, their shared interest imparts durability to their cooperation since “they won’t in the next two decades stab each other in the back.”[107]

There is little complementarity to Chinese-Russian relations in Africa. Instead, they are best described as compartmented: rather than coordinating their activities so that they are independent but mutually supporting, the two often simply stay out of each other’s way, both functionally and geographically. Functionally, China focuses on the diplomatic and economic instruments of statecraft while Russia focuses on military presence, especially in the form of the Wagner Group and other PMSCs. As China’s African economic interests expand, its security presence is likely to increase to protect them. How Russia reacts to this will be an important indicator of the overall state of the relationship. Geographically, outside of South Africa, China and Russia focus on distinct parts of the continent. For China, the Horn of Africa and the Gulf of Guinea have been focal points, reflecting their importance as trade routes and, in the latter case, a source of oil exports. North Africa and the Sahel have garnered the lion’s share of Moscow’s interest in Africa, the former due to long-standing economic relationships with countries like Egypt and Algeria, and the latter due to its attractiveness as a playground for the Wagner Group and other Russian PMSCs. Five countries—Angola, CAR, Ethiopia, Mali, and Sudan—import arms from both Russia and China and have PMSC presence from both. Even here there is little evidence that the two are coordinating their activities.

While China and Russia do not overtly compete in Africa, some of their objectives are misaligned which could cause problems moving forward. Although both, like all countries, keep their own interests at the forefront of their policies in Africa, China has an element of win-win cooperation within its interests which is missing from Russia’s. Moscow sees Africa in far more instrumental terms and is more fixated on undermining Western influence, even at the cost of stability. China’s approach is more broad-based, combining infrastructure investment, capacity building for African governments, and regional security engagement. The goal is to extend China’s model of governance to Africa and beyond and build markets for Chinese goods. For China to achieve this, it requires stability, making Russia’s role as an agent of chaos unhelpful. How much disruption Beijing is willing to tolerate is unclear, but the answer will reveal much about the state of their relationship.

The views expressed in this article are those of the author alone and do not necessarily reflect the position of the Foreign Policy Research Institute, a non-partisan organization that seeks to publish well-argued, policy-oriented articles on American foreign policy and national security priorities.

[1] Information is also often considered an instrument of power, but it is more difficult to directly measure than diplomatic, military, and economic instruments, so I do not consider it here.

[2] Dr. Paul Tembe, Associate Professor at the University of South Africa, interview with the author, August 24, 2022.

[3] Charles A. Ray, “South Africa’s Naval Exercises with China and Russia: Cause for Concern?” Foreign Policy Research Institute, April 13, 2023, https://www.fpri.org/article/2023/04/south-africas-naval-exercises-with-china-and-russia-cause-for-concern/

[4] Sandile Ndlovu, Chief Executive Office of the South African Aerospace Maritime Defence Council (SAAMDEC), interview with the author, August 22, 2022.

[5] Ibid.

[6] Dr. Philani Mthembu, Executive Director of the Institute for Global Dialogue, interview with the author, August 24, 2022.

[7] Ndlovu, interview.

[8] Ibid.

[9] Tembe, interview.

[10] Dr. Woldeamlak Bewket, Professor at Addis Ababa University, interview with the author, August 29, 2022.

[11] Mthembu, interview.

[12] Dr. Patrick Maluki, Professor at the University of Nairobi, interview with the author, September 1, 2022.

[13] Camille Behnke, “Putin searches for more friends at Africa summit but low turnout dampens bid for influence,” NBC News, July 29, 2023, https://www.nbcnews.com/news/world/putin-searches-friends-africa-summit-low-turnout-dampens-bid-influence-rcna96599

[14] Gerald Imray, Mogomotsi Mogome, and John Gambrell, “Iran and Saudi Arabia are among 6 nations set to join China and Russia in the BRICS economic bloc,” The Associated Press, August 24, 2023, https://apnews.com/article/brics-russia-china-summit-b5900168d165cc78b36d5d5c068b7a50

[15] Gerald Imray, Mogomotsi Mogome, and John Gambrell, “Iran and Saudi Arabia are among 6 nations set to join China and Russia in the BRICS economic bloc.”

[16] Mercy A. Kuo, “China-Russia Cooperation in Africa and the Middle East,” The Diplomat, April 3, 2023, https://thediplomat.com/2023/04/china-russia-cooperation-in-africa-and-the-middle-east/

[17] Dr. Philani Mthembu, interview with the author.

[18] Mathieu Droin and Tina Dolbaia, “Russia Is Still Progressing in Africa. What’s the Limit?” Center for Strategic and International Studies, August 15, 2020, https://www.csis.org/analysis/russia-still-progressing-africa-whats-limit

[19] “South African Presidential Palace: Hope to play a mediating role in the Russian-Ukrainian conflict (南非总统府:希望在俄乌冲突中发挥调解作用),” China Internet Information Center, March 12, 2022, http://news.china.com.cn/2022-03/12/content_78103688.htm

[20] Abraham White, Leo Holtz, “Figure of the week: African countries’ votes on the UN resolution condemning Russia’s invasion of Ukraine,” Brookings Institution, March 9, 2022, https://www.brookings.edu/articles/figure-of-the-week-african-countries-votes-on-the-un-resolution-condemning-russias-invasion-of-ukraine/